The confining chains of insurer Legacy Technology has been written about by many including myself. Many carriers, brokers, MGAs and Reinsurers have managed to cope applying ‘bandaid’ digital software in layers around creaking old infrastructure. Yet we have all seen the plummeting shares of global brokers as announcements were made of distribution innovation by deploying AI: -

Tuio and Insurify stories showing what AI-native distribution could look like in practice.

'For years, the insurance user journey has followed the same rhythm: search, quote, compare, decide, purchase. Multiple steps. Multiple platforms. Multiple intermediaries.

AI now has the ability to compress that into something closer to a single interaction.

One interface.

One prompt.

One decision moment.'

Matt Connolly of Sonr

It is not quite the revolution to cause the shares to drop but the whole distibrution of P&C insurance will change as customers look for unmet needs to be satisfied, new products, value and convenience. The majority of Insurtech investment across Europe is still in distribution and investors are nervous as to which companies will optimise strategy and operationalisation.

Which brings me back to core systems and SunCorp in Australia.

Suncorp is banking on investments in artificial intelligence and a multi-year core systems overhaul to make insurance more accessible, including for Australians and New Zealanders who have already been priced out of coverage – even as extreme weather drove the insurer’s first-half net profit after tax down to $263 million.

The company is progressively implementing Duck Creek – a cloud-native, software-as-a-service policy administration system – to replace what Duck Creek Technologies described in December 2024 as “multiple on-premises legacy systems. This platform has proven itself live for new home and motor customers under the AA Insurance brand in New Zealand, and Johnston said results there were encouraging. Note other core systems are available! I am not promoting Duck Creek.

CEO Johnston acknowledged the tension between current pricing pressures and household cost-of-living strains but said ongoing technology investments were central to the insurer’s response.

“Over time, with the things we’re doing with AI and Digital Insurer, we need to get better at designing new policies, new premiums, [and] new products for that subset of consumers who are really challenged to continue with their insurance,” he said.

I read this as looking at an existing subset of customers whilst the medium-term challenge for all insurers will be to consider the probable changes in distribution and having adaptable core systems that are able to enable rapid innovation. Able to power the AIs that could deliver competitive advantage with relevant and unperished data. But AI, like technology is an enabler and not the strategy key.

Rory Yates made the same point today: -

"If everyone just applies AI to existing value models it will make differentiation harder not easier!

If you simply accept that everyone is just injecting AI into their worn & torn legacy and it's magically becoming hyper intelligent and therefore different (or more valuable) - think again! This just quickly resets the playing field anyway.

The winners will be the ambitious insurers who own truly differentiated data and capabilities to utilize it, and that these can’t be replicated easily. And that these new data lead paradigms achieve things customer can actually experience & feel.

1️⃣ Embedded into my life and things, helping me continuously navigate my risk:insurance life...

2️⃣ Risk mitigating where possible, predicting and preventing bad outcomes, or helping me make better choices...

3️⃣ Adapting to me as my life changes, allowing me to increase or decrease coverage as needed, with careful and personal guidance…"

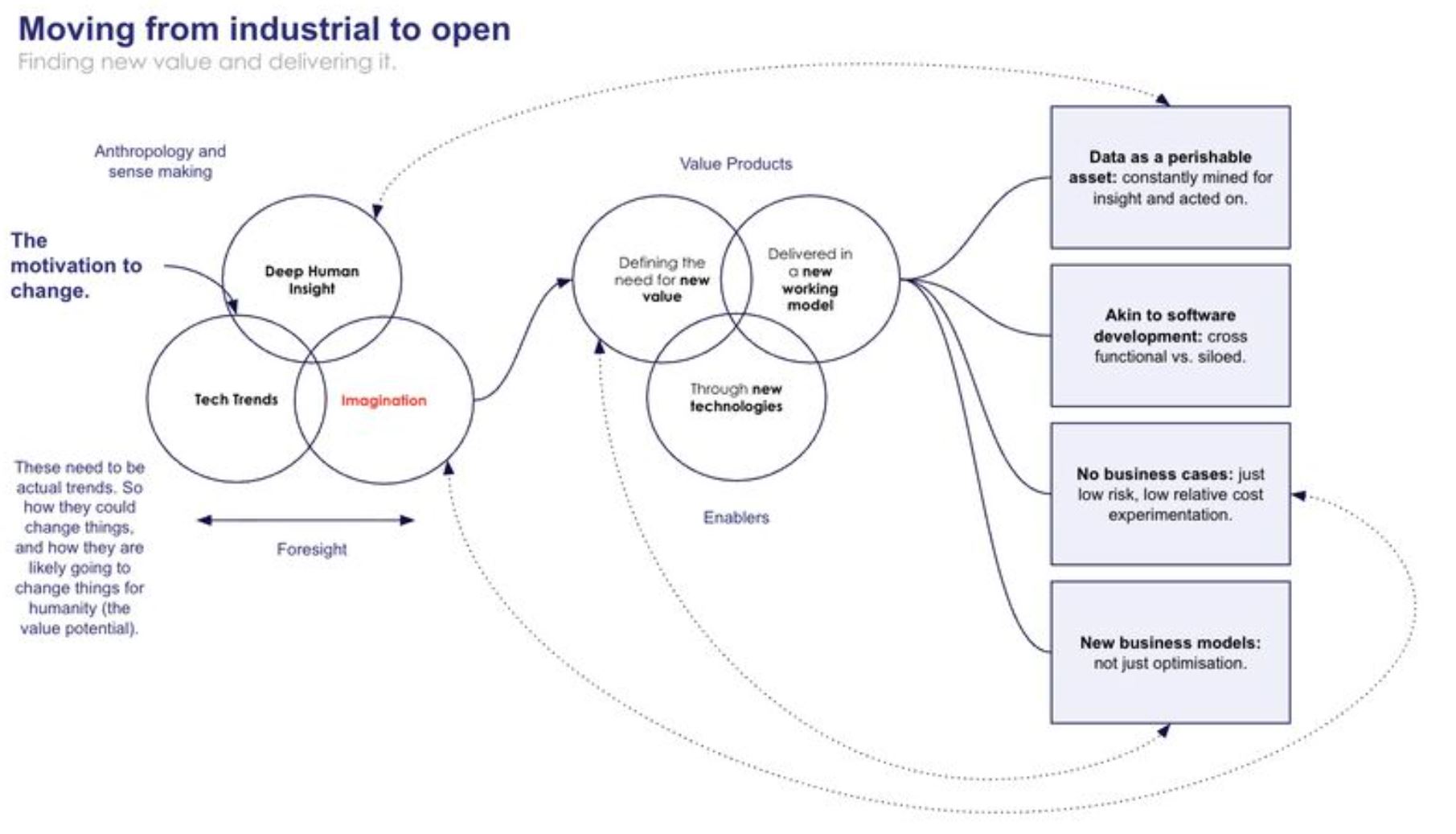

He calls for an ‘Imagination Economy’ to deliver new value, new business models and use cases. His visualisation of the process is spot on.

SunCorp's strategy and deployment seem to be more optimisation than new value though I may be doing them a disservice.

A centrepiece of Suncorp’s AI stack is SunGPT, an internal platform built on Databricks that connects the company’s customer and operational data with large language models in what the company describes as “a safe and secure manner,” according to reporting by iTnews.

One application running on SunGPT is Single View of Claim, a generative AI tool that consolidates communications, building documents, and case notes into a unified claims summary and recommends next steps for resolution. The tool – accessible to about 1,500 claims staff – reduces per‑claim review time by between five and 30 minutes, depending on complexity.

An insurer must start somewhere and ensure every new AI innovation meets internal and external compliance regulation. Suncorp are doing just that and this experimentation allows it to train and resource staff to achieve more ambitious and imaginative innovation. Not a bad lesson for all insurers.

Consider the different distribution channels that, with imagination, could meet future needs across various types and combinations of insurance: -

Embedded

Parametric

Micro

Affinity

Traditional

I'll leave the last word to SunCorps CEO :

“As a distributor, we see opportunities for AI to both strengthen the effectiveness and deepen the customer engagement across our market-leading brand portfolio. This will equally apply to consumer and commercial, or as premium pools move between those portfolios over time.”

Suncorp is banking on investments in artificial intelligence and a multi-year core systems overhaul to make insurance more accessible, including for Australians and New Zealanders who have already been priced out of coverage – even as extreme weather drove the insurer’s first-half net profit after tax down to $263 million.

unknownx500

unknownx500