This article describes transforming claims from a back-office reactive operation to the strategic asset to retain customers and boost profits. And in the way avoiding disruption.

- Making claims a strategic asset- boosting customer retention and growth

- The links between digital maturity and customer satisfaction

- Management and team reporting in near-real-time for better decisions

- Four key enablers to achieve success

Making claims a strategic asset

"The insurance sector is notoriously low touch.

There are arguably only four key customer journeys: taking out a policy, renewal, making a claim and cancellation. Customers tend to only hear from their insurer once or twice each year, and these are usually dull, administrative interactions. Then it’s radio silence until it’s time to renew again.

Few people relish the insurance claims process. When the time comes, customers want to be able to report their claim 24/7 on the channel that is most convenient. They also want to be able to submit supporting documentation as quickly as possible. Transparency and constant communication is crucial. The journey should end with a timely, fair settlement.

Making a claim is a high peak. It’s the moment of truth when the insurer either comes good on their promises or they don’t. People judge an experience on how they felt at the peak, or the end of an experience, when emotions are most heightened. This is the thinking behind the peak-end rule, based on the work by Daniel Kahneman.

The claims team has an outsized influence on making or breaking the customer relationship."

John Aves CP2 Experience in The (in)convenient truth about insurance claims Dec 9th 2021

So it must be worrying to read the J.D. Power 2021 U.S. Claims Digital Experience Study, in which Martin Ellingsworth executive managing director of P&C insurance intelligence at J.D. Power states

“At a time when virtually every other industry is experiencing significant gains in digital customer engagement, the insurance claims process has not really evolved beyond the launch of digital photo estimation three years ago,” Ellingsworth continues:

“It’s no secret the industry has been investing heavily in back-end technology such as straight-through processing, which should help set the stage for faster, more personalized digital claims management tools. But right now, there is still a great deal of room for improvement in these functions. It is also critical to note that satisfaction is highest when claimants have options to interact via the channel they choose and not feel forced into a one-size-fits-all experience.”

Boosting loyalty through service and process

The first notice of loss (FNOL) is often the first interaction that a customer has with their carrier. It’s one of the most important elements of the customer experience for claimants. This is borne out in J.D. Power’s Auto Claims Satisfaction Study and Property Claims Satisfaction Study. The data analytics and consumer intelligence company found that the way an insurer handles FNOL accounts for 25% (auto) and 26% (property) of insurance customer’s satisfaction. The combination of services available at FNOL have a major impact on satisfaction levels.

But satisfaction is won or lost across the whole claim process and there is a very large difference between a claim for accidental damage (A&D) to a TV or phone and the long drawn out process to put right extensive fire, flood and earthquake damage. Or the complexities of commercial insurance where both carriers and brokers are involved.

Yet many articles written about claims talk about technology as if Platform X or Y is ideal for all categories. Or for both P&C and Commercial Insurance. That is rarely the case and each platform has strengths and weaknesses.

Let's keep it simpler for mow and just look at home and auto claims in the UK and USA.

The links between digital maturity and customer satisfaction

Looking at the insurers that rate highest by CUSTOMERS in the UK.

NOTE: these are listed alphabetically, not by score.

What is really interesting is that to be in this top group does not mean that an insurer need rate highest by digital maturity i.e. the degree to which the insurer has digitally transformed. Take two cases amongst the best performing- ,AXA and NFU Mutual.

They have been rated for digital maturity over the last few years by the Altus DigitalBar measuring 18 different criteria from Quote % Buy to claims AXA has many green capabilities and a score of 62% whilst NFU Mutual is a sea of red and rates only 4%. Yet both score high on customer satisfaction overall and for claims. How can that be?

The NFU Mutual brand is known for high trust, good service and products with professional claims adjusters and supply chain partners. The analogue approach works but even so NFU Mutual is investing heavily in digital transformation based on a Guidewire deployment which shows that the best approach is to optimise the mix of human empathy and skill with the best of technology. All part of a vision, strategy and execution capability that delivers best outcomes for customers, staff, partners, investors and the Board.

Various research studies back this up and links are given at the end of the article.

Nevertheless, despite the assertions of some technology vendors, none of this is easy.

J D Power states:

“The auto insurance industry has been investing heavily in streamlining the claims process and those investments are starting to pay off in the form of faster cycle times and record levels of satisfaction,” said Tom Super, head of property and casualty insurance intelligence at J.D. Power. “The challenge now will be continuing to drive service improvements as vehicle prices normalize and claim severity continues to increase. Those carriers with more sophisticated claimant triage will be better positioned to navigate the growing cost and complexity ahead.”

The 2021 survey also points out customer dissatisfaction issues .

- Phone still dominates estimator phase, dragging down customer satisfaction: Just 40% of claimants interact with their claim estimator via digital channels, while 49% interact with their claim estimator via phone. The average overall customer satisfaction score among those claimants who use the phone is 861 (on a 1,000-point scale), lower than in any other interaction channel. Use of video chat with an estimator is associated with the highest level of overall satisfaction (882), yet it is experienced by just 26% of claimants.

- Key satisfaction metrics being missed: Digital claims management tools are hitting their key performance indicators for the estimation process just 35% of the time and for digital reporting just 40% of the time.

- Generational disparities magnified: Members of the Boomer1 generation are using insurance digital claims tools less and experiencing lower levels of overall satisfaction than are members of Generations Y and Z.

“The insurance industry really needs to look at what leaders in the banking and wealth industries are doing with their web and mobile apps as a guide for where customer expectations have moved during the past several months,” said Michael Ellison, president of Corporate Insight. “Simple, easy-to-use tools, like calculators and estimators that help customers set realistic expectations and provide important information throughout the process go a long way toward driving engagement and end-user satisfaction.”

Customers often want very simple things done well e.g. keep me informed what is going on and what comes next as Nationwide visualises for its US customers.

Lesson- don't run until you can digitally walk and focus on what customers want rather than what you think they will need. Nothing makes up for poor customer research or technology solutions looking for a problem to solve.

Lesson- don't run until you can digitally walk and focus on what customers want rather than what you think they will need. Nothing makes up for poor customer research or technology solutions looking for a problem to solve.

"USAA is seeing claims reported digitally at a 50% clip, but also increased calls to the call center, says Ramon Lopez, VP of claims operations. But that isn’t, in his estimation, because the process is confusing them. Rather, supply chain issues are causing repairs to take longer in general.

“There’s parts and labor shortages. So what we might be hearing as a challenges with adopting digital is in fact that people simply have further questions around why repair times are being elongated,” he explains. “That

wait time may not have been the norm for food to be delivered or for groceries to be delivered.”

Lopez says that insurers need to be identifying and studying those pain points and causes for them, and figuring out ways within the claims process to reach out proactively and address them. "

The pain points will often be outside the internal processes such as supply chain constraints, rapid parts and labour cost inflation, used car price inflation etc. That is where skilled and empathetic claims adjusters and supply chain team members are worth their weight in gold. Augmented by technology of course to help them make faster, better informed and better decisions for customers, the company and business partners.

Humanising the claims experience – Zurich

Zurich has partnered with Sprout AI to roll out an automated policy checking system to reduce claims times (even for six-figure sums) to just a few hours instead of making customers wait days for a decision. But Zurich is also invested in the well-being of its customers and recognises the psychological and emotional toll that making a claim can take.

Last year it launched Zurich Support Services whereby claimants and their immediate family have access to five free counselling sessions. The insurer offers more than just counselling at a time of loss and customers can talk about anything from daily life worries to major life events. If they can’t help, they will recommend somebody who can. This is how you differentiate on experience when the G-Force for the sector is rooted in digital.

In a another article I investigate choosing the right technology partner ( see Further Reading) but for now I just want to touch on one other important topic.

Management and team reporting.

Work-in-Progress is by nature spread over many departments and teams. Not just claims but supply management teams, fraud, legal, finance, marketing, sales..... Silos of data everywhere.

Technology vendors often love to talk about end-to-end platforms and systems but often fail to walk the walk as you will find gaps in the platforms. And a great deal of activity and communication goes on outside the claims operation in the supply chain.

An escape of water or drainage issue involves clarification as to whether it is the responsibility of the water company or the insurer. Subsidence requires geological and site surveys by different professionals. A growing number of contractors, sub-contractors and self-employed professionals become participants in repair and replace claims and so much of the communication is often outside systems. Yet here is a valuable nugget of gold- early warning signs of impending dissatisfaction.

Only by bringing all the parties involved into a single digital record can an insurer record and capture data in emails, SMS messages, video streaming and where recorded, phone calls. The triage, communication and orchestration capabilities of modern claims playtforms can enable this but stuill must be combined with supply chain strategy, management and operations. Home, motor, health, pet- doesn't matter it is important.

That means all the participants to settling claims must have secure access to claims platforms which must only present that information and insights that any company/individual is authorised to see/hear. And whatever the capabilities of the platform the insurer must have the formal relationships and trust of these participants to be a part of the growing 'ecosystems'.

When that is in place with the technology insurers can capture the gold nuggets of insights in near-real-time e.g. sentiment analysis of conversations and video streaming to highlight potential anxiety or dissatisfaction in time to take remedial action. Insurers can also capture the insights from disparate and multiple data sources inside and outside the company to add to the effectiveness and speed of decision taking and execution. I'll explore more of that in my next article on choosing the ultimate technology partners and software/platforms.

In these days of parts and materials shortages, labour availability being impacted by Omicron self-isolation and component price increases making estimation of lead-times and cost more challenging you can see the results osn insurers and customers.

Historically high repair times have prompted many insurance carriers to consider adjusting the rental allocated days in their policies, Susanna Gotsch, the senior director and industry analyst for CCC Intelligent Solutions, told a CIECA webinar audience recently

During her 50-minute presentation, “2022 and the New Norm in the Collision Industry,” Gotsch said that, across the industry, CCC data shows that DRP repairs took more than 12 days on average in 2021, or two full days above 2020.

“Subsequently, we hear more carriers saying that their customers are experiencing issues when they run out of their rental allocated days based on their policies,” she said. “And many carriers have said that they’re looking at the number of days within their policies to determine whether those should be adjusted to help consumers.”

That’s especially true with rental policies that require the customer to pick up additional costs resulting from longer repair times, Gotsch said.

In its most recent quarterly length-of-rental (LOR) report, Enterprise Rent-A-Car said that overall LOR in the fourth quarter of 2021 reached 17.0 days, an increase of 1.8 days from the previous quarter, and 3.9 days from the same quarter of 2020.

Effect on customer satisfaction

Another effect of longer repair times, and one that body shops might want to note, is the relationship between longer times and declining customer satisfaction, particularly in the higher price brackets.

“We’ve seen repair times climb, but we’re also seeing more repairs shift into these higher dollar repair brackets where cycle times are longer. And by the time we get to a $10,000 repair or higher, the average repair time exceeds 35 days,” Gotsch said.

This chart from CCC shows the details.

It just shows how insurers that can embrace their supply chains in close commercial relationships and share the benefits of the various technology platforms that can potentially more easily manage the cost and time to deliver vehicles back to customers and deliver customer satisfaction. In the US/Canada, Europe, Asia Pacific- everywhere.

Deloitte in "The Future of Insurance" stated that :-

Claims is a key growth engine for customer retention when the total value chain is transformed. Traditionally considered a part of the back office as a reactive operation claims will have to become a powerful differentiator.

- Innovative in nature

- Uncompromising on customer service

- Multifaceted in the capability of its talent

- Capable of driving strong results

Deloitte identified four key enablers necessary to achieve this.

- Process Innovation

- Technology

- Connected Partner Ecosystem

- Talent

Process Innovation

Licensing technology before the vision, goals and strategy are in place is putting the cart before the horse. Not to mention that claims is a part of the overall strategy of products, services, support carriers decide on to be in the top quartile of companies and anticipate disruption.

I discussed this in How incumbent carriers survive, thrive or will be disrupted.

So let's stick to claims for now.

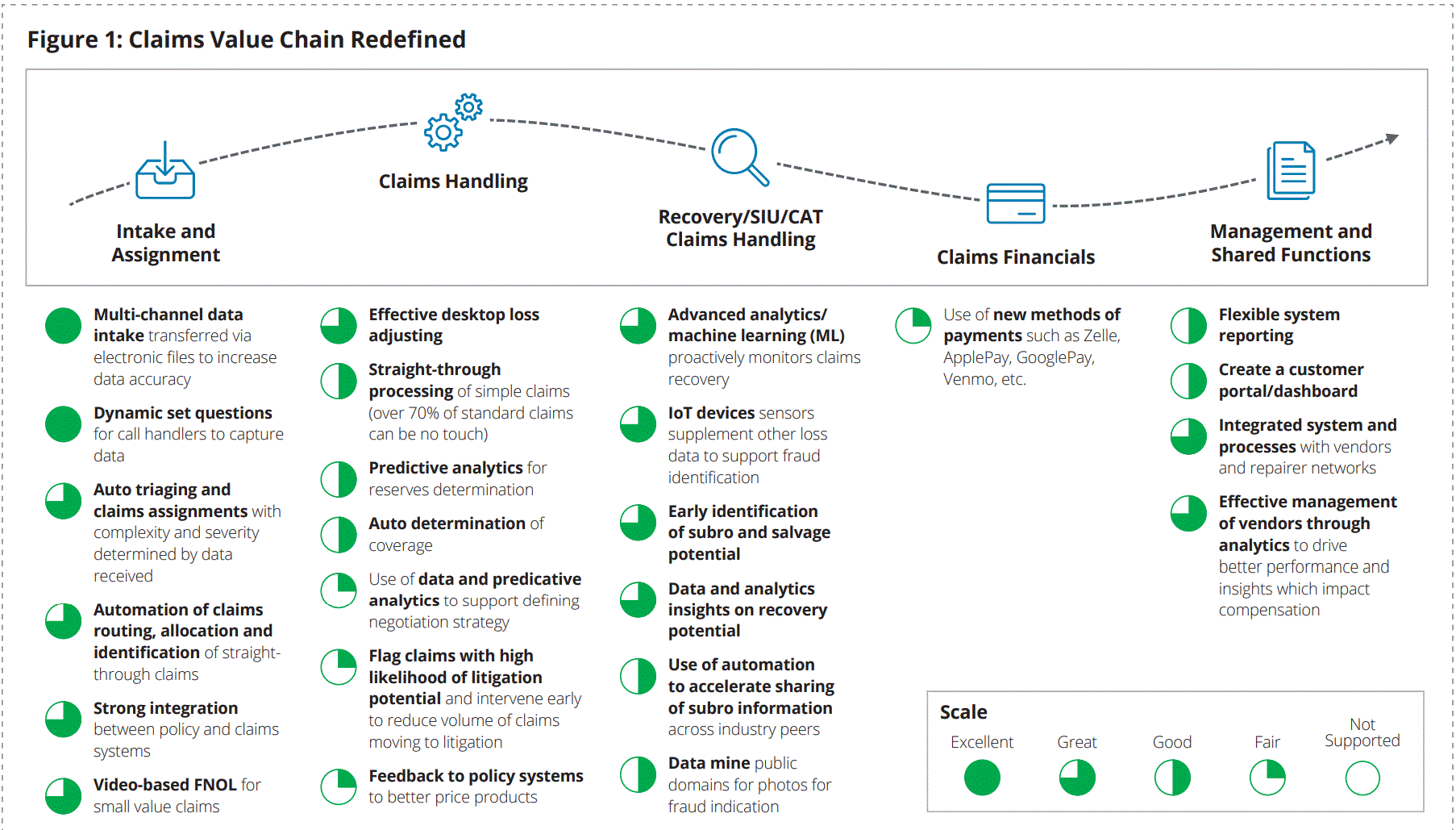

Source: Deloitte Future of Claims

It might have been published back in August 2020 but is still very relevant.It cannot be done in one go so strong leadership setting the priorities and delivering outcomes customers demand is vital.

Technology

This should aim to segment claims by complexity and service requirements. Technology is the enabler for express claims and the augmenter for core and specialist claims.

The great advances in the use of large and diverse data combined with IoT, AI & RPA , advanced analytics, virtual inspections and software to achieve touchless claims in home and auto claims is concentrated in express claims and will augment claims adjusters in core claims.

Technology is the enabler for express claims and the augmenter for core and specialist claims. Claims platforms themselves are dependent on core systems so coretech modernisation maybe the backbone to enable claims excellence.

Before we come to a partner ecosystem we should recognise the need for a technology ecosystem. Too many claims technology vendors rely on exporting data slabs for the insurer to ingest onto the corporate BI systems but that is a crude option. Claims, supply chain, fraud, legal, marketing, brokers, all need the insights in near real-time to make and execute systems. Deloitte visualises this well in its Insight Maturity Curve.

How far along are you on this curve? A mix of technology and professional advice is vital. To manage a partner ecosystem it is vital to progress left to right.

Connected Partner Ecosystem

We have already identified this as the apogee of the new mixn of protection- of risk prevention and risk mitigation. Supply chain constraints, cost inflation, labour moving between companies attracted by premium wage/salary offers, tendency for contractors to discard insurers that they don't trust for those they so have shown up those insurers without viable ecosystems.

Traditional partnerships involved leveraging 3rd part administrators, business process outsourcing partners, independent adjusters and inspectors, repair networks and legal partners.

Partnerships will evolve to focus of delivery capabilities, optimizing delivery regardless of the mox of partners involved. It will shift the role of the claims adjuster from being an information gatherer to that of being an insight enabled decision maker.

That's why talent is such a key to differentiation.

Talent

A clue to the change is in the common description of the claims call centre. A hub to gather information, pass it to relevant departments, and take calls from customers who want to know what the hell is going on.

An insight enabled decision maker role changes that to real customer engagement. Where customers, colleagues, partners and brokers/agents are automatically kept informed in near real-time.

That requires preparing the workforce whilst technology automates administrative and transactional tasks that take up most of a claims adjuster's time. This demands an incredible width and depth of capabilities and these individuals will be hard to find and retain. Seeing as many claims adjusrers are retiring over the next few years it is fortunate that technology can take over admin and transactional tasks freeing a smaller number of more highly skilled and rewarded team members. Deloitte term these "Claims Exponential Professionals"

Just look at the reskilling and training necessary. Don't be fooled into thinking that Low-code/no-code is a panacea. You need skilled, able business decision makers to leverage these. They may be in the company or hired in. In the future you will be able to contract some of these through blockchain enabled, smart contract sourcing platforms for specific but temporary projects.

Wow- we have covered a great deal and we can summarise the use of process innovation, technology, partner ecosystems and talent management to: -

- Transform contact centres to engagement centres

- Cross-train claims team

- Upskill FNOL agents

- Cross-skill FTR's across lines of business

- Implement training to teach employees to effectively adjust and interact with customers

- Leverage updated KPIs, performance review methodology and training to develop claim leadership qualities

- Leverage technology to augment human intuition, empathy, decision making.

Conclusions

if nothing else I hope I have put technology in its place as an enabler and not an end in itself. The technology partners you need are those that have the capabilities, resources and commitment to help you along that long journey. That have skin in the game. I well remember the partner to be which offered me a FTE to help me prepare a digital transformation programme and business plan. That took 12 months and they got the business despite late-comers trying to undercut them.

Knowing that you have true support and an interest in your goals and your numbers makes such a big difference to your success

Further Reading

Speed of settlement, customer satisfaction and AI

Creating value, finding focus and choosing the right technology partners

“I think we've seen a large transformation in customer utilization of digital claim capabilities the last few years, and a significant uptake on the part of customers,” says Pat Gee, SVP of claims at Travelers. However, Gee adds, customers are still getting used to how the digital capabilities, which range from first notice of loss to status reports to virtual inspections and everything in between, work. The next step is to understand where new kinds of questions are being generated along the way