Florian Graillot has been an investor for many years with an eye on insurtechs that can help insurers manage emerging risks. He publishes newsletters from AsoryaVC, of which he is active, which are insightful. I went back to a June edition which included a report from Swiss Re on ‘Emerging Risks’ and it was useful to compare this with an article in HBR by Thomas Burbel, CEO of AXA, on how he and his teams have repositioned AXA to deal with emerging risks combined with a switch to prevent risk as well as mitigating it.

The article covers: -

- Emerging Short & Medium Term & Structural Risks

- How should insurers manage these risks?

- Four high impact strategic shifts

- Balancing long & short-term strategies

- The burden of legacy & new legacy technologies

- Further Reading

1 Short-term, medium-term & structural risks

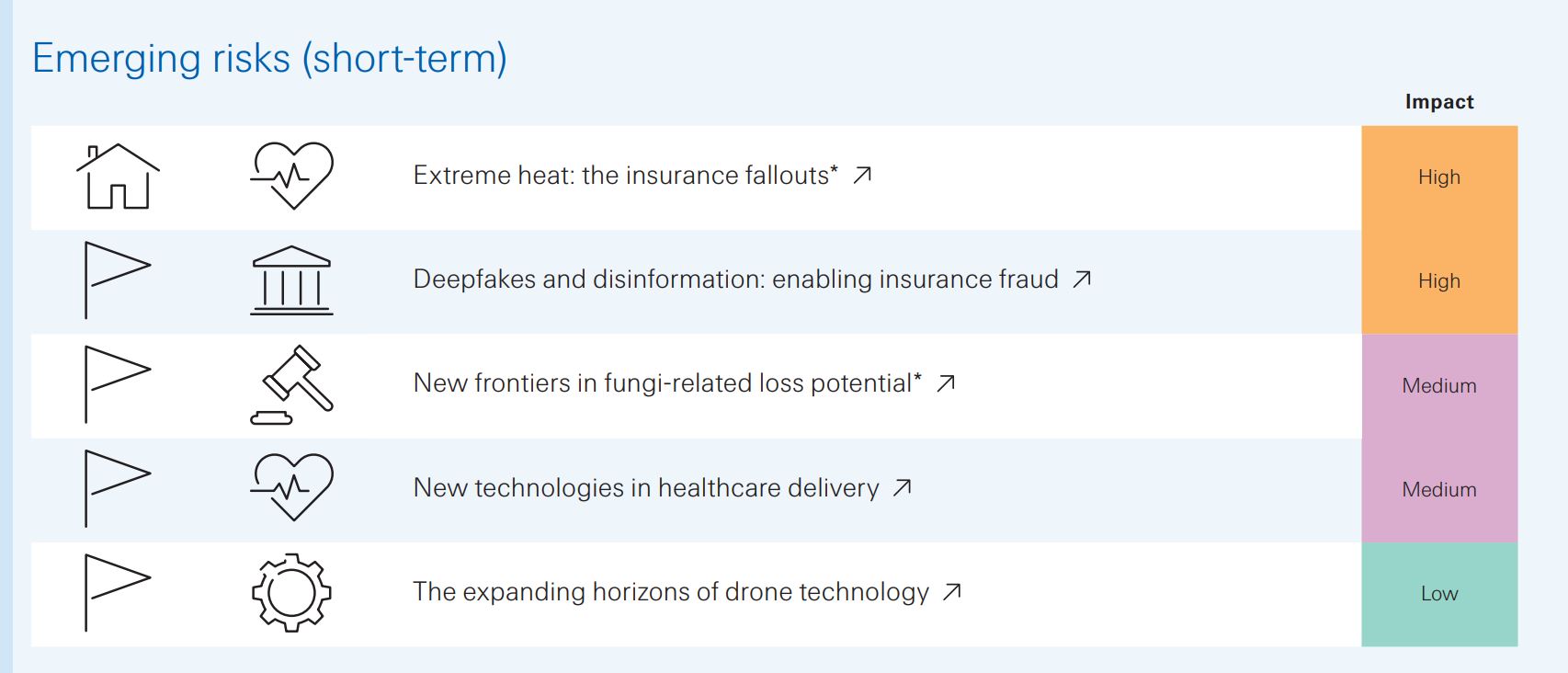

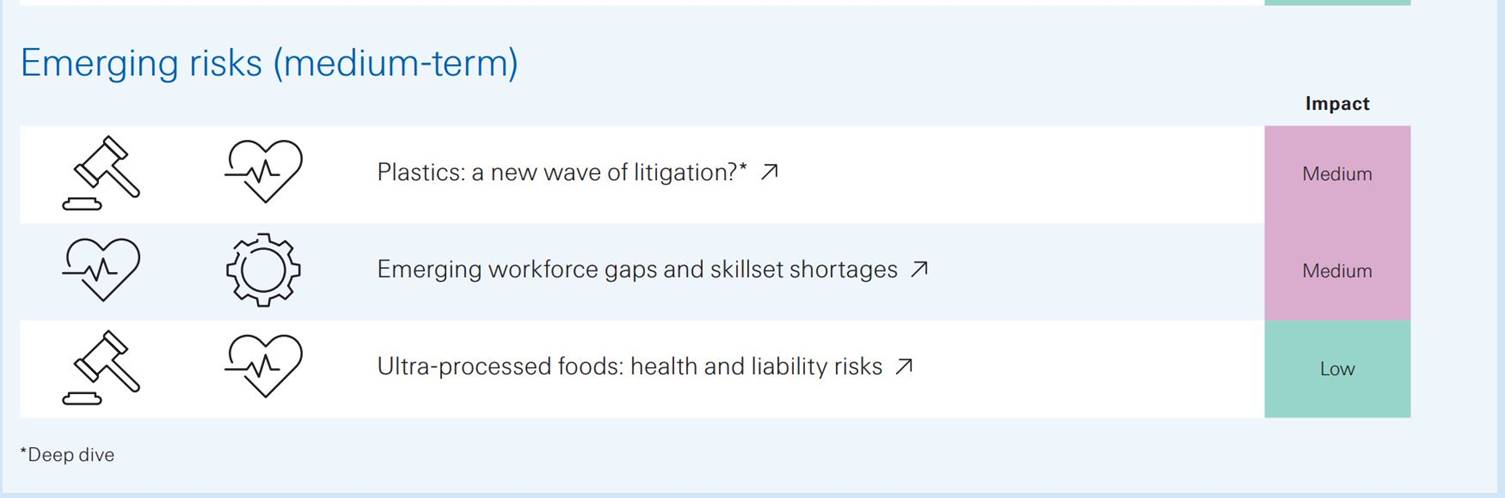

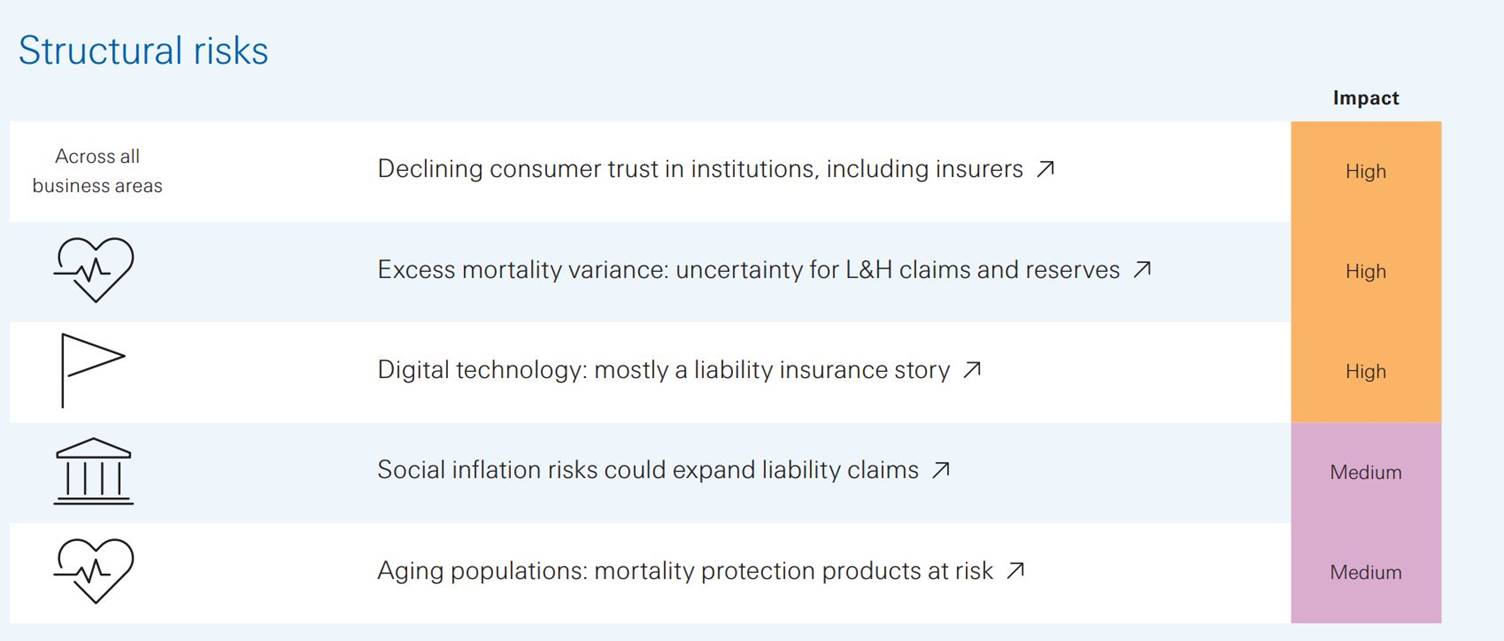

Swiss Re describes emerging short & medium-term, and structural risks.

Short-term Risks

Medium-Term Risks

Structural Risks

A link to the full report can be found in the appendix Further Reading

2 How should insurers manage these risks

How well prepared are insurers to anticipate and manage these risks? I have long argued that many are limited by the core systems they have inherited over years of M&A activity, and which do not support the data ecosystems vital to leverage the new technologies and software that help insurers compete with incumbent and new competitors.

I don't just mean legacy technology but also the newer platforms that are still complex, costly, inflexible and not MACH architected.

- M- micro-services based; independent components integrating via APIs

- A- API first; exposes all functionality and data to modern ecosystems

- C- Cloud native; elastic scaling and automatic updates

- H- Headless; separate back-end technology to front end presentation layer

These MACH certified platforms will enable enterprise-wide ecosystems that deliver a customer-focussed rather than policy-centric way of delivering customised products and services to customers and managing emerging and structural risks. A selection of such platforms is in section XXX

Burbel describes the priority at AXA to tackle: -

- Climate Change

- Geopolitical Instability

- Public Health Crises

- Social Tensions

- Economic Inequality

This is the context of helping companies and individuals thrive by preventing and distributing risk. AXA aims to protect customers through the effectiveness of its underwriting combined with the power of its investments. It envisages itself as an orchestrator and facilitator for a ‘Community of Customers’. I've written elsewhere on the aspect of underwriting which you can find in the appendix Further Reading below. Data, identified by AXA and many others, is a challenge being unavailable, or at least patchy, for the new economy. Even when it comes to electric vehicles (EVs) many brokers and MGAs still seek cover for customers without suffering excessive premiums.

AXA has a business unit- AXA Climate- researching the risks of global warming.

On investments, AXA is committing €5BILL p.a. to invest in ESG, low carbon and environmentally positive companies. Putting its money where its PR mouth is.

Adapting to a more uncertain environment is part of AXA's stated transformative shift.

Capgemini in a recent report surveyed the key new risk cover required to deal with demographic ageing. (Link to full report in appendix Further Reading

Ageing and urbanizing populations

- Global dependency ratio increasing; by 2050, for every 100 working age people, there will be 20 seniors to support- up by 63% from 2025.

- The world is becoming more urban; by 2050 circa 77% of global population will live in cities.

- Ageing + Urbanisation will result in complex, concentrated property risks.

- Smaller, older households in densely populated areas.

- Single occupants, many HNW individuals with assets in properties vulnerable to higher CAT event risk

- Requiring ‘in place’ assistance services

- Reshaping mobility solution requirements

- Insurers must respond to these shifts.

- Geographic variations between US, Europe, Asia

- Wealth concentration

- Capacity and pricing challenges

Renting and Experience seeking younger customers

The other side of the coin is the younger generation of people renting smaller homes and shifting to enjoying experiences rather than owning assets.

- 70% renting smaller homes

- 45% shifting preferences for experiences rather than owning assets.

- Insurers need to respond by

- Redesigning for flexibility

- From structure to contents- electronics, collectibles, appliances in rented apartments, co-living spaces, and even storage facilities

- From tangible to intangible assets like data and IPR.

CapGem concludes by saying:

"The aging population acts as a risk amplifier — more dependent on infrastructure, more vulnerable to disruption and more difficult to insure using legacy models. Combined with global urbanization and climate risk, today’s threats no longer exist in isolation. They are interlinked, cascading across property, liability and service lines.

Today’s customers no longer seek simple indemnity after loss. They want help avoiding the loss, navigating disruption and bouncing back quickly. Assistance-based contracts — once an add-on — are becoming central to the value proposition of P&C insurance.

The winning insurers of tomorrow will be those who act today: combining tactical upgrades in pricing and underwriting with long-term structural shifts in ecosystem partnerships, customer experience and workforce transformation."

3 Best practices for insurers: Four high-impact strategic shifts

1. Recalibrate geographic focus

Insurers must realign their growth strategies with demographic realities:

- Pursue high-growth emerging markets. India’s economy is expected to be $30 trillion by 2050, with strong commercial line expansion. Early entry positions will be key.

- Balance mature and growth markets. Mature markets like North America are projected to hold a large share of the P&C insurance industry while growth markets like India are projected to significantly rise in importance. Diversified portfolios are essential.

- Urban-centric underwriting. More than half of the world’s people — over 4 billion people — live in urban areas. With 68% of the population living in cities and half of those urbanites over age 50 by 2050, insurers must develop products tailored to dense, aging city centres.

- Climate-aware strategy. Nearly the entire global population — 98.5% — will face drought risk by 2050. Insurers must bake climate exposure into their geographic playbooks, especially in countries like the U.S. and Australia.

2. Create age and lifestyle-friendly service models

Product and service design must keep pace with changing customer capabilities and expectations:

- Move from indemnity to assistance. Once considered niche, assistance-based models are becoming essential in P&C insurance, as consumers increasingly expect support not just after a loss, but throughout the entire risk life cycle — before, during and after an event.

- Simplify interfaces. User experiences must be intuitive, with clear terms, minimal decision friction and 24/7 access to guidance.

- Enable aging in place. With 70% of customers not planning to move, services that support home maintenance, health and accessibility are increasingly vital.

- Protect experiences, not just possessions. Coverage needs to reflect the rise of experience-based living — covering travel, leisure and service-related liabilities.

3. Build strategic ecosystem partnerships

The interconnected and tech-dependent nature of tomorrow’s risks demands collaboration:

- Mobility ecosystem integration. With over 65% of new car sales in Europe and the U.S. expected to be autonomous by 2040, partnerships with automakers and transportation networks are key.

- Smart home and health tech alliances. Nationwide’s partnership with Resideo Technologies illustrates how insurers can leverage IoT to mitigate risk proactively.

- Public-private climate collaboration. Infrastructure resilience will be crucial for continued insurability in hazard-prone areas. Partnering with governments is a strategic imperative.

- AI and analytics integration. Munich Re’s aiSelf ™ solution shows how insurers can address risks introduced by their own AI systems, reinforcing the need for tech-first collaboration across underwriting, claims and customer service.

4. Transform talent strategies

Aging is reshaping the entire insurance workforce, not just customers. Talent strategies must evolve accordingly as well:

- Accelerate knowledge transfer. As experienced professionals retire, structured mentorships and documentation systems are critical to preserve institutional knowledge.

- Scale digital reskilling. Equip current teams with analytics, AI and automation skills to stay competitive.

- Retain older workers. Offer flexible work models, such as phased retirements, consulting roles and part-time options, to keep experienced voices in the room longer.

- Diversify recruitment. Attract talent from tech, data science and customer experience backgrounds to infuse fresh thinking into the insurance workforce.

Demographics are a strategic priority

Demographic change is no longer just a concern for life insurance or a distant macrotrend. It’s a strategic, operational, and risk-management priority for every function in the P&C business.

The aging population acts as a risk amplifier — more dependent on infrastructure, more vulnerable to disruption, and more difficult to insure using legacy models. Combined with global urbanisation and climate risk, today’s threats no longer exist in isolation. They are interlinked, cascading across property, liability, and service lines.

Today’s customers no longer seek simple indemnity after loss. They want help avoiding the loss, navigating disruption and bouncing back quickly. Assistance-based contracts — once an add-on — are becoming central to the value proposition of P&C insurance.

The winning insurers of tomorrow will be those who act today: combining tactical upgrades in pricing and underwriting with long-term structural shifts in ecosystem partnerships, customer experience and workforce transformation.

I am sure that the C-Suites are anticipating these challenges but maybe that is wishful thinking. How do they prioritise their time between the dreaded quarterly reporting, the demands of shareholders, and the fact that many of their customers seem to distrust them whether personal lines where price is often the deciding factor, health and life where costs rise and expectations increase, or commercial where many customers see insurers reluctant to pay put fairly whether for business disruption or CAT event losses?

It is not as if population demographic changes are the only challenges facing insurers.

4 Balancing short and long-term strategies

Or, competing on price today and on service and value tomorrow

Only recently, many motor and home insurers faced worsening combined ratios as the unprepared faced severe claims inflation. So much so that prominent CEOs were hoisted on their own petard and we saw interesting M&A activities as stronger insurers acquired weaker rivals.

Commercial insurers saw the rising costs of CAT events from all points of the globe.

There is no substitute for predictive capabilities, strategic genius, and sheer good management prowess. The ability to look ahead and make more right decisions than bad ones. To ruthlessly eliminate what is not working and focus on what is with positive and major impacts for customers, the enterprise and stakeholders.

Technology is a tool and not a substitute for that. Generative AI will not deliver the answer as it, by nature and architecture, dumbs down to the average rather than raises quality towards the top quartile.

Nevertheless, when the leadership has chosen the best priority problems to solve and opportunities to leverage, various combinations of technologies will be vital to help achieve these plans.

That has been the course of history with insurers in the forefront of augmenting skilled professional staff by deploying mainframes, departmental servers, PCs, smartphones and connecting these via on-prem, cloud, hybrid, and internet-enabled ecosystems.

Therein lies one of the chains binding insurers to a rigid past and restricting innovation. The multiple technology stacks acquired during global and national expansion and increasing exposure to legacy technology.

5 The burden of legacy technologies hinders innovation

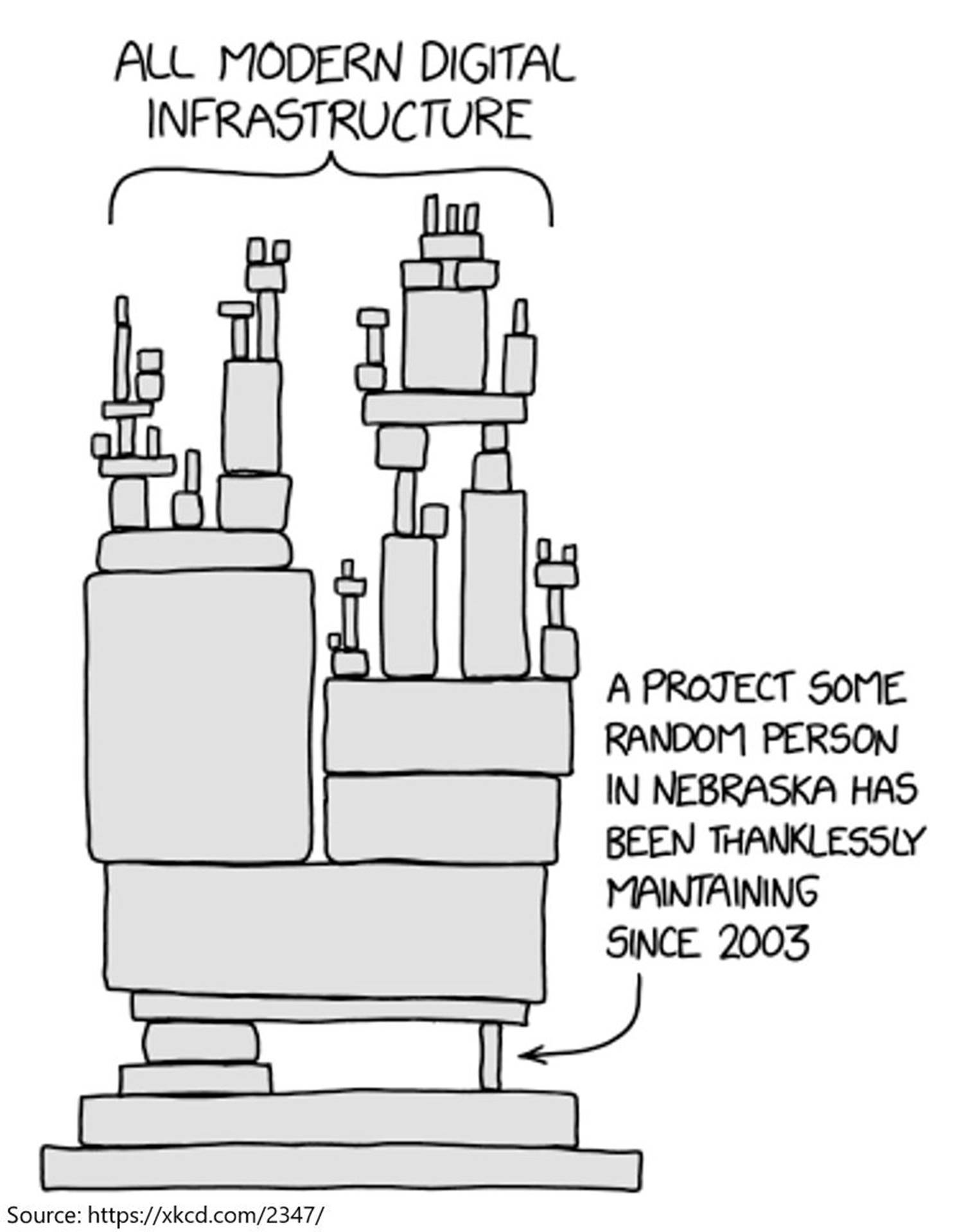

This particular diagram expresses the problem well.

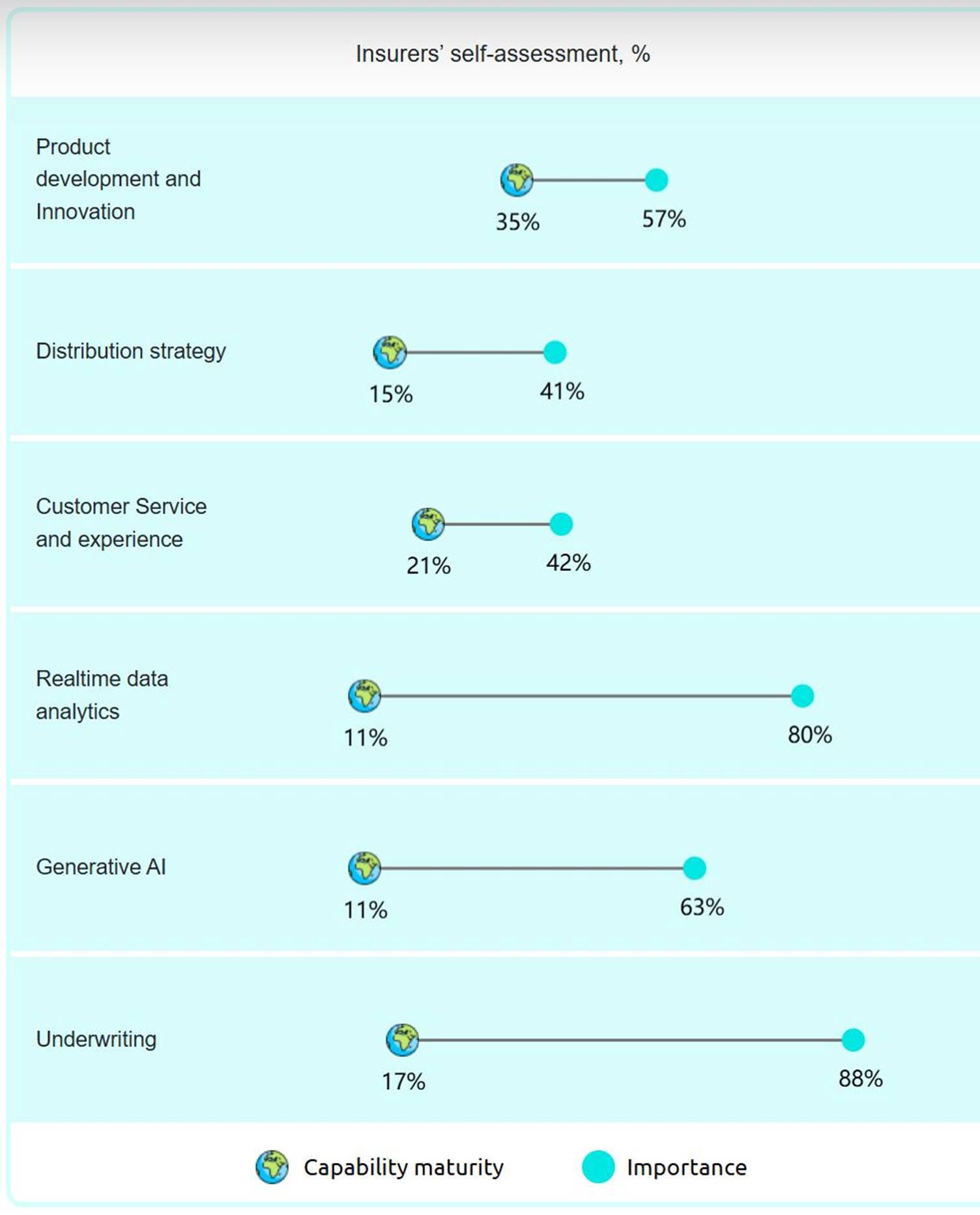

This and other legacy technologies across enterprises is a reason insurers' own assessment of their capability maturity across the insurance value chain show the major gaps to be bridged.

Source: Capgemini Research Institute for Financial Services analysis, 2025

You can view this analysis by country here in Highlight 4

Add to this the often-awful procurement processes employed to experiment. Heard of the one where a senior VP spends $4m on a project without involving LOB staff? Hires a new outfit to deploy it, which reports back that it doesn't work in practice, employees are not using it, and they all go back to spreadsheets?

It is typically stated that 70% of POCs and MVP trials fail. That is over a long period from the early days of CRM, through the e-commerce boom and bust, thrusting blockchain on an unprepared organisation to the modern-day rush of lemmings to fall over a cliff of ill-thought-through Generative AI and Agentic AI trials.

Below I explore the hype of promise fuelled by the humungous money invested in Generative AI and LLMs, epitomized by the image of Sam Altman and OpenAI promoting technologies with well-documented flaws and error-strewn outputs. Don't forget, the same applies to adopting and deploying all kinds of technology without proper planning and knowing what you need to achieve.

Data, systems, and innovation

Insurance was founded on data and domain knowledge in the coffee houses in London's streets where expeditions to far-off lands sought finance and insurance from the dangers and uncertainties of exploration and global trade.

Data is still the competitive advantage when unlocked, surfaced, orchestrated, analysed and, combined with human intuition, leveraged by technologies to innovate and deliver the products and services that people, companies, organisations, institutions, and governments need to create a better world. And insurance lies at the heart of that.

Balanced on a technology project maintained by a random guy in Nebraska who has since left, leaving no manuals, shared knowledge, or means of keeping it going!

Insurance really needs a new business and operating model.

Data fluid: able to treat data as a perishable asset, constantly mining it for insight and acting on it as close to real-time as needed.

Built around a customer and not a policy: For example, operating an “API” first model and assuming this is the way you successfully integrate is not sufficient for orchestrating expanding ecosystems. You need to be able to rapidly adapt to make those partnerships work in the context of a process, efficiency, and customer/employee experience.

Multi-agent & multi-model: Whatever AI you are using today, it will likely be obsolete very soon. The ability to harness AI is also about interoperability and control. Probabilistic models offer us a new way of interacting and shaping outcomes. Agentic AI will take this to another level. Insurers must ensure they have the right kit to move quickly and outpace their competition.

The reality? As tempting as key AI use cases might be, wiring them into legacy systems deployed in most insurers could be a costly mistake. Complex point solutions, welding you to key GenAI models, creates dependencies on specific AI models that aren’t easily changed. Equally, harnessing these services to ensure you don’t fall foul of a hallucination, or ways to control the data is highly complex.

Let’s not build AI Skyscrapers on bungalow foundations."

Quote from Rory Yates

Firm foundations and infrastructure

Too many insurers have deployed AI as a patchwork of unconnected point solutions rather than as a strategic enabler within a sound and well-connected infrastructure.

High-quality data is the bedrock of AI success and AI is as subject to ‘Garbage in, Garbage out’ as much as any other technology and process. You will have heard of hallucinations causing generative AI to sometimes deliver complete rubbish because it has been trained on large data that contains rubbish. Add to this LLMs are contextually blind, forget previous output, have no empathy, and you can see where we are going.

The LLMs that have trawled data from public sources will combine true and useful facts with conspiracy theories, lies, and predict cause and effect where there is none. There are tools and processes to help weed these out and we are always warned that professionals should validate outputs for accuracy.

A firm foundation is vital to validating training, measuring output accuracy, and correcting mistakes until constant accuracy to acceptable levels is achieved. Especially in a highly regulated industry in which insurers deal with matters of life, death, injuries, loss and sorrow.

Ensure automated data integrity through external verification - using tests for code and definitive answers for math problems. This process acts as a filter, excluding low-quality inputs. Organizations can replicate this rigour by developing domain-specific verification systems, such as knowledge graphs that map factual relationships and give context to the relationships between people, companies, professions, locations etc (e.g., verifying used vehicle pricing values against established and current research).

Refining models on small and specialised language models using proprietary data offers another route to accuracy but you will also want to ingest external data. Add to that the stream of historical and real-time data coming from the many platforms and applications deployed in an insurer and you can see the need for data curation, categorisation and orchestration.

The Systems Infrastructure Conundrum

Insurers still rely on legacy technology; mainframes and decades-old software to reliably powering transactions and unchanging processes. Global insurers even more so because of M&A activities, acquiring different technology stacks that are incompatible and unconnected in each country.

Those that invested in core systems like Guidewire, Duck Creek and Majesco invariably did so in one line of business, like motor, whilst its home and contents business runs on older technology. Additionally, Guidewire can hardly be labelled an agile and flexible core system. This has mattered less whilst most policies stay as annually renewed products with little innovation. Things are changing though. New competition, the changing needs of younger generations, and unmet protection gaps (see further reading) put pressure on insurers to be faster to market with personalised service and products.

That opens the potential for new MACH-architected core systems that enable personalisation, support dynamic innovation, and the data orchestration capabilities described above. We see insurers often choosing these platforms for new product launches to add flexibility, fluidity, and the ability to apply the ‘test & learn’ experimentation we have discussed. In alphabetic order, these include:

- EIS

- FintechOS

- Genasys

- ICE

- Instanda

- Ignite

- Novidea

Data curation

Curating data that is relevant, accurate and as complete as practical is an essential task.

1. Which key processes and decisions need improving to achieve strategic goals?

2. What data is required?

3. What mix of AI tools will best accomplish desired outcomes?

4. Configure tools to test, learn, and apply successful outcomes

5. Build out issue by issue within a longer-term strategic plan

The data collected will invariably be from multiple sources, mostly unstructured, and must be categorized to make it AI Ready by creating a Universal Data Layer:

• Named entity recognition.

• Term matching

• Contextual awareness

• Leading to focus on relevant data

• Real-time data for dynamic decision-making

Demanding work augmented with data automation tools such as the Aiimi Insight Engine. This can be leveraged by an insurer’s own data teams and augmented by Aiimi’s own vast team of data scientists, engineers, and architects. Similarly, Palantir is moving into insurance from its own strengths in the military, government, and healthcare markets.

Data curation and categorisation are too important not to collaborate with AI and data technology partners.

That is before you consider data orchestration.

Data Orchestration

To become a customer-centric organisation that personalises products and services requires managing the many relations across entities, people, and assets, joining the past and present with the predicted future outcomes. Adding to the complexity, these relationships are spread over multiple core systems of record, policy admin systems, point solutions, and data sources from data warehouses to silos.

Managing and orchestrating data for just one outcome is challenging enough so managing for multiple outcomes increases the complexity geometrically. This will involve a rigorous experimentation and ‘test & learn’ phase in which the accuracy of outcomes is measured until full confidence is achieved in every outcome.

This leads to the world of Agentic AI. Agents within the insurers connecting to and transacting with external agents making decisions to optimise outcomes for both customers and insurers.

Suffice to say that if enterprises have found it a challenge to turn single-use case pilots into successful deployments Agentic AI is a step too far. Accomplish success by applying the steps described above in sole use cases will allow you to move on. The pressure to advance from the traditional policy-centric business model of insurers to become customer-centric will put extreme pressure on legacy-based IT systems which are the underlying infrastructure of most insurers- the other part of the infrastructure challenge.

Current and trending status of AI

In the world of Generative AI and LLMs, the shockwaves that DeepSeek generated explain everything. Investors and highly valued AI vendors from Anthropic and Meta OpenAI were blindsided by the newcomer from China that claimed to deliver more for less. Hardware, software, and cloud infrastructure companies suffered dramatic, plunging stock prices and even cries of ‘foul.’ It is still a Wild West landscape with, every week, new products, releases, and claims of enabling transformation. CPT5 is about to be released by OpenAI which improves the integration of multiple AI tools.

Remember, though, that they may all be obsolete by the time you scale up and operationalise AI which is another reason to collaborate with partners that recognise that.

AI is, of course, far more than Generative AI, Large Language Models, and Agentic AI. It has its roots in the mid-twentieth century and today many mature AI tools are deployed analysing data and predicting outcomes. The launch of ChatGPT by OpenAI heralded the hyped promise of Generative AI and trained LLMs to automate, reduce costs, improve customer service, complete research, and generate innovative plans. Vendors claim we are approaching the point when it will perform as well as, and even better than humans. The point of Artificial General Intelligence (AGI). Mmmm….

Teams of Agents would replace much of human teamwork automatically answering questions, guiding purchase decisions, underwriting risk, settling claims, and changing insurance forever. In reality, practitioners in the market that prefer reality to hype say that large enterprises seek solutions to mundane problems rather than seismic shifts.

Maarten Ectors, a former Chief Digital Officer at Legal & General GI followed by a successful role at L&G Group (Life, Pensions and Investments) as Chief Innovation Officer. Insurers are cautious we know and still he delivered award winning innovations that complied with the strict security policies of L&G and the industry regulators.

"What are the problems and use cases that large enterprises seek digital workers to take over?

He has ambitious plans and is co-founder of start-ups including Greentic.ai an open-source platform “To create armies of digital workers".

That is the company that is engaged with large enterprises which mostly most want simple boring and highly repetitive problems to be automated by digital workers.

In IT this can be an employee asking via Teams for getting access to some SharePoint, the digital worker checking who is the owner of this SharePoint, sending the owner a Teams message to ask if it is OK to add this employee and, if yes, adding the employee, if no, letting them know their request was denied.

Same for chatting with Salesforce, ServiceNow, Jira and getting simple but highly repetitive jobs done without humans doing anything more than providing oversight and approvals.

Employees will be able to add more assistant skills in the future which integrate more and more systems. So, the trick is to find highly repetitive work that humans don't like to do but requires calling some systems and responding to some questions. Systems like MS Power Automate or Zapier are normally not good enough in this fast-changing AI environment.

It does show how you do need to have a coherent strategy to experiment, learn, and choose optimal use cases that offer you a competitive advantage. Like it or not, you are experimenting already.

Many of the point solutions that insurers adopt already embed AI tools in their products.

RightIndem embeds AI in its digital claims platform to:

• Prompt claimants registering claims via eNOL to fill in missing and vital details

• Automatically categorising clauses and subclauses to triage claims faster

• Detecting inconsistencies in claims e, g. described weather with actual weather conditions

• Validating claims against policy wording, inclusions, and exclusions

Insurers should embrace this development of AI in the context of the entire insurance value chain just like The AA.

Hyperexponential automates underwriting processes allowing underwriters to spend less time on admin processes and more time underwriting. It leverages Generative AI and other tools. Underwriting and Claims are two parts of the value chain that insurers should surely connect more. If you deploy both RightIndem and Hyperexponential you need the tools and support to orchestrate the intere4stections between both apps. An AI and data orchestration layer

Cytora digitises risk for the commercial insurer leveraging LLMs and multi-agents to process higher volumes of submissions, at lower marginal cost and greater control. Some clients will combine hyperexponential and Cytora for risk management.

This picture expands to all parts of the value chain from product planning, through distribution, to supply chain management, counter fraud, and automating payments. Every time you start a trial with one or more apps/platforms that leverage AI you are experimenting with AI.

Like any project, the same detailed planning must be put in place to maximise successful outcomes.

1. Executive adoption decisions based on something other than FOMO

2. Compelling use cases – will tackle real problems and/or leverage significant opportunities

3. Honest and complete business case ROI

4. Systems engineering thinking

5. Effective test campaigns i.e. test, learn & iterate

6. Users buy-in to vision and the experiments

7. Understanding of the technology's true capabilities & the technology's true limitations

9. A backup plan if the experiment fails

10. Self-reflection over prior failures; what has changed in our approach this time?

11. Have the technology partners you chose ‘eaten their own dog food’ and proved they can deliver the outcomes you desire using the tools they promote?

Thanks, offered to Chris Surdak for this advice- Chris has been deeply involved with all aspects of AI since his days at NASA. Yes- AI, RPA, deep-learning have a long history.

These are the ‘hard yards’ that Rory Yates refers to.

You can see this with Johnson & Johnson after three years of experimentation with AI, including Generative AI

The Johnson and Johnson Case Study

"Johnson & Johnson has shifted its generative AI strategy away from broad experimentation across the healthcare conglomerate to a more focused approach.

Chief Information Officer Jim Swanson said the move ensures that the company allocates resources only to the highest-value generative AI use cases, while it cuts projects that are redundant or simply not working, or where a technology other than GenAI works better.

Another lesson is that AI augments humans and does not replace them. That's for a longer-term future.

“That was a pivot we made after about a year of learning,” Swanson said. “Now we’ve moved from the thousand flowers to a really prioritized focus on GenAI.”

"The “thousand flowers” approach involved a number of use case ideas germinating from across the company, which made their way through a centralized governance board. At one point, employees were pursuing nearly 900 individual use cases, many that were redundant or simply didn’t work, he said. And as the company tracked the broad value of AI, including generative AI, data science and intelligent automation, it found that only 10% to 15% of use cases were driving about 80% of the value, he added.

Now J&J is drilling down into high-value generative AI use cases around drug discovery and supply chains, as well as an internal chatbot to answer questions on company policy.

“We’re prioritizing, we’re scaling, we’re looking at the things that make the most sense,” he said. “That was part of the maturation process we went through.”

Source: WSJ | CIO Journal

A 10% to 15% success ratio is par for the course for any IT projects. That is why it is vital to plan as I've described above and, like J&J, weed out the unviable use cases ruthlessly.

AI in all its guises is not for the faint-hearted whilst the same should be said for all new technologies unleashed on business.

I love this quote from David Tyler in Business Cloud

“I think the biggest thing businesses can do is start by forgetting that AI exists. Then analyse their business and look at where decisions are made, how they’re made and what can be done to improve those decisions. Once you have that, then start looking at which elements of AI can help you.

“Ultimately, to get anything meaningful out of AI, you need to get very good at defining the problem you want to solve – in detail. That will become the new superpower.”

6 Appendix: Further Reading

SONAR 2025 New Emerging Risks from Swiss Re

The aging demographic pivot demands strategic P&C insurance transformation

Capgemini's ‘World Property and Casualty Insurance Report

Insurance risks across market segments Munich Re

I find it interesting as we believe 'emerging risks' are the new wave of insurance innovation. Historical data are limited - if non existing at all - and require algorithms to ultimately unlock insurance capacity. These are opportunities where tech players - startups - are better positioned in my opinion.

unknownx500

unknownx500