There are far too many doomsters spreading misinformation about the UK to support their extreme views- many of them British! I discuss the facts, how the UK's financial services are in a position to lead on the responsible deployment of AIs, and the challenges of legacy technology and a lack of international trust and cooperation

Contents

- London's and UK's core global strengths

- Focus on Financial Services

- Coping with technical debt

- AI Agents and protecting humanity

- The Trust Paradox

- Further Reading

UK's Global Strengths

First the UK is not the sickly nation many portray.Populist politicians fan the flames. Rupert Lowe, a former Reform UK MP, recently described London on X as a place that “increasingly resembles the third world” and is “certainly not safe for women”. He got over 2.3m views.

The data tell a different story. Violent crime has been in decline in London for years. The annual number of robberies has remained steady since 2010, even as the population grew by roughly 1m. In 2024 the number of people admitted to hospital for “assault by sharp object” was the lowest in at least a decade. With 1.1 homicides per 100,000 people, the lowest since comparable records began, London is safer than Paris (1.3) or Berlin (3.2). New York, a city roughly London’s size, which famously became much safer, has almost three times as many homicides.

Residents of Miami are almost six times more likely to be killed.

London remains the world’s second-largest financial centre (after New York) and produces more unicorns ($1bn-plus startups) than anywhere else in Europe. Four of the world’s top-ten universities lie in its orbit. Above all, the world’s best and brightest flock to the capital.The UK stock market and AIM are on a roll. The UK is the 6th largest economy in the world. The UK is good at: -

- Advanced manufacturing

- Materials of the Future

- Life Sciences

- Financial Services

- Technology including AI, Fintech, Insurtech and Legaltech

Take financial services.

Britain is an outward facing country. It's position on the extreme west of the European continent has always given it and its people an independent streak.

London's global financial strength started as a result of the nation's exploration and expansion overseas, the opening of trading stations and the need to insure explorer's ships and cargoes. The coffee houses of London were the places investors, insurers and traders met and from which Lloyds of London grew. The British Empire expanded and reached its apogee in the early 20th Century. Today, London's position in the middle time zone between The Americas and Asia plus its financial services innovation and leverage of technology still give it a competitive strength.

Wall Street may have dented its position and European and Asian rivals seek to chip away at its market share but London is still a core British success story. Take the current focus on the field of AI and tools like Generative AI and Agents.

The UK's financial services sector is the world's most aggressive and advanced adopter of generative AI, particularly in moving from pilot to production. This sectoral strength is a critical part of the UK's strategy to maintain its global financial dominance.

- EY's survey of 1,200 financial institutions globally found that UK financial services firms are the world's most active adopters of generative AI.

- Key Stat: 92% of UK financial services firms have either implemented, are piloting, or are planning generative AI initiatives. This was a higher percentage than any other major market surveyed, including the US.

- Deployment Depth: Crucially, 48% of UK firms reported they had already implemented at least one generative AI use case into production (not just a pilot). This was the highest implementation rate globally and double the rate of US firms (24%) at the time of the survey.

- McKinsey's 2023/2024 global survey Professional Services" sector (which includes legal, consulting, and financial services) stated that the UK is the top adopter of generative AI across all industries globally.

- The UK government's own survey (Department for Science, Innovation & Technology (DSIT) - "AI Adoption in the UK" (2024)) found that approximately 22% of all UK businesses had adopted any form of AI (which includes generative, robotic process automation, machine learning, etc.) as of early 2024. The report highlighted that adoption is heavily skewed towards larger firms. The UK has a larger proportion of SMEs than EU countries. SMEs tend to adopt new technology slower than large enterprises. That will change though in 2026 as they see the benefits and learn from the mistakes of early adopters. Crucially, the survey noted that generative AI is the fastest-growing type of AI being adopted.

Anecdotal evidence from innovators suggests that UK enterprises are focused on use cases that match the current capabilities of Generative AI and Digital workers. High volume, highly repetitive, predictable and well understood processes - the boring and mundane admin that takes up too much of human workers' time. AI to augment humans (deployed effectively) will yield high returns.

There are challenges of course. Companies struggling for growth may be tempted to cut back their investments in AI to maintain profits in the short term. There is no evidence of that though.

Change is not just about technology. Equally important are company culture, change management capacity, training and resourcing and the ability to brief and get buy-in from all those involved in planned transformation. It is also the will and stamina to tackle technical debt.

Removing technical debt from the enterprise

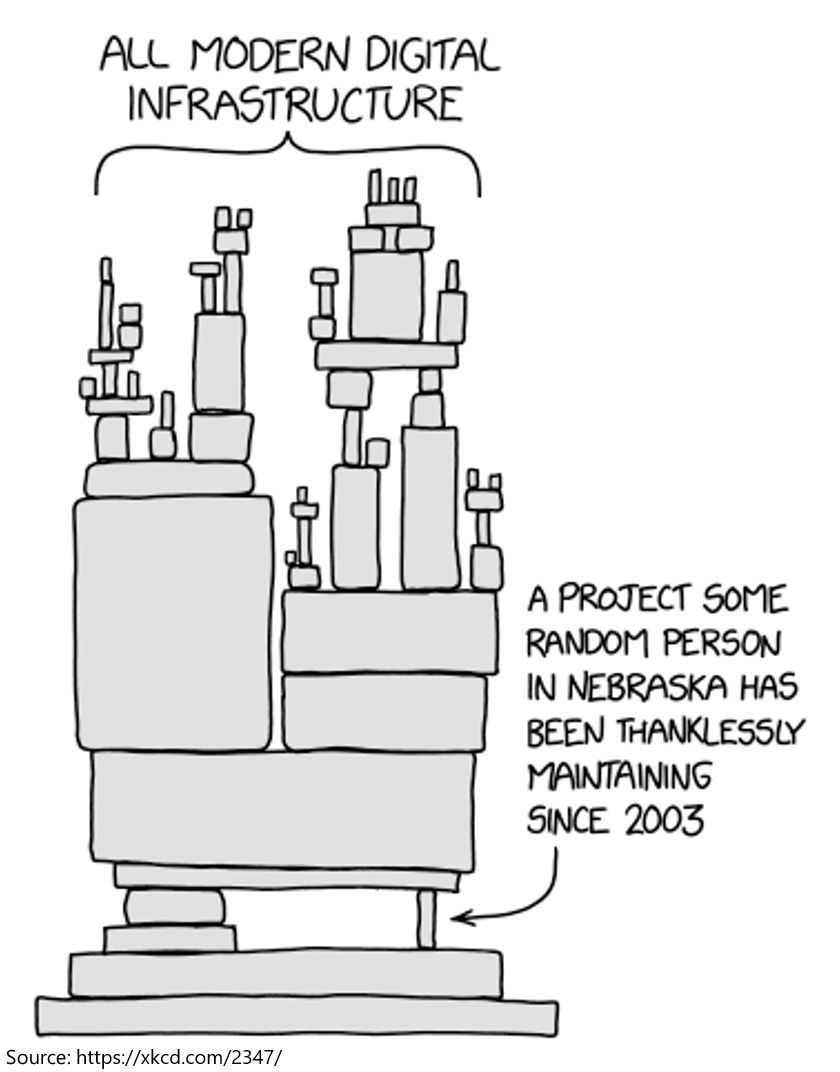

This image has appeared often and it still has impact.

Oops; the Nebraska guy actually retired last month!

Take Gen apps which is a timebomb ticking away in many an insurer and bank.

GEN (also known as GENASYS, Life/70, Prolog/2) was a fourth-generation language (4GL) and application development environment widely adopted by insurers from the late 1970s through the 1990s. Gen apps are still at the core of many- especially in the Life Insurance, Annuities & Pensions and Reinsurance sectors. The US lags behind UK financial services tackling this legacy debt.

- 25-30% of UK life insurers still have GEN at core (down from 60% in 2010)

- 40-50% of US life insurers still dependent on GEN systems

- Expected timeline for significant presence: Through 2030s

- Complete elimination unlikely before 2040 for most complex cases

Gen apps are still found across: -

- Policy Administration Systems (Life, Annuity, P&C)

- Claims Processing Systems

- Billing and Commission Systems

- Underwriting and New Business Systems

- Reinsurance Administration

- Customer Information Systems

A dwindling number of experts and legacy tech practises make it harder year by year to tackle this time bomb ticking away into the next decade. The UK seems to be ahead of the US in tackling the transformation to modern architectures which is another factor making AI deployment faster. and effective.

Legacy systems chain the ability of central IT to operationalise and scale new technologies. The planning and organisation process cost multiple times the cost of AI. And AI is not an island unto itself. Take all the other tech and data that has to be transformed!

In parallel to the legacy technology challenge the whole issue of legislating against the real potential of AIs to act against an insurer's interests and indeed against humanity.

Agents, protecting humanity and regulatory compliance

The Allianz Risk Barometer 2026 (see further reading) describes AI as rising from #10 in 2025 to #2 this year. The #1 risk, cybersecurity, is closely linked with AI as are other categories including political risk, macroeconomic and market developments, and changes in legislation and regulation.

Most British insurers are experimenting cautiously with Generative AI and Agents. That is not to say that there are not many deployments at some companies- rather that they are restricted to specific use cases which are well understood. The compliance policies and regulatory requirements placed upon insurers help ensure that. The Financial Conduct Authority (FCA) is analysing the long-term implications of the field of AI and UK insurers must also comply with regulations in other jurisdictions that impact the UK eg DORA from the EU..

Given the thrust of this article that UK financial services industry is at the forefront of deploying AI, it is likely that is will also be at the forefront of anticipating the risks of agents and with the FCA et al and the UK government keeping humans in control.

This is important as delegating decision-making to an ever increasing number of agents could reach a point where the underlying complexity of the algorithms and processes is beyond human understanding. It is not as if this is the first time this has happened.

The 2008 financial crash and demise of Lehman Brothers can be attributed to a lack of regulation, lax risk management and the selling of dubious financial products. Lehman Brothers capitalised on the housing boom by investing heavily in mortgage-backed securities (MBS) and collateralized debt obligations (CDOs), which promised high returns in a low-interest-rate environment. How many people in the industry, governments and institutions actually understood the complexity and minutiae of financial markets at the time? How many do today?

Concerted coperation and action by governments and central banks saved the day but is was a close run thing. Lessons were learnt, new leislation and oversight introduced and banking and finance became more resilient to global risks.

There is a danger that this could happen again in the case of delegating decision-making to AI powered agents. It is easy to understate the degree to which decisions are automated today before considering GenAI and Agents. Loans, mortgagages, risk cover acceptance- all depend on social scoring. The speed at which compute power increases with chips like Nvidia's and data centres being built accelarates the whole process.

The UK is in a good position to be at the forefront of ensuring that these technologies do not develop beyond the capabilities of us humans to reign in harmful risk before it is too late. The UK cannot act alone of course but in cooperation with the EU, USA, China and nations such as India ensure that gobally AI is implemented for the good of humanity and not the greed of large tech billionaires and politicians who could be on a non-stop elevator of trying to win the race for Artificial General Intelligence (AGI) and Artificial Super Intelligence (ASI). The bosses of Microsoft and Anthropic have warned of the dangers to humans of bad actors and unregulated companies deploying current and new tools that create chaos. At the same time they are part of this rush to win the race to achieve AGI.

To complicate matters this not just an industry or national issue.

Financial Services, including insurers, cannot act in isolation. In this connected world chaos in one area spreads to others. When the news broke that Lehman Brothers had filed for Chapter 11 bankruptcy, the immediate reaction from markets was severe. Stocks plummeted, and the Dow Jones Industrial Average recorded its largest single-day point drop, closing down 504 points. Financial institutions began to reevaluate their positions, leading to a liquidity crisis as banks became reluctant to lend to one another, fearing further collapses. This liquidity freeze deepened the crisis, making capital increasingly inaccessible.

Major banks, such as Bear Stearns, Merrill Lynch, and AIG, either collapsed, were acquired, or required significant government intervention to remain viable. The crisis created a contagion effect, wherein fear of losses spread throughout financial markets, triggering runs on banks and financial institutions. Britiish consumers queud at ATMs to withdraw cash at Northern Rock bank until the cash ran out. Economies tanked.

I have not even considered the political motivations of, say, the Chinese and US governments to deploy agents and eventually AGI to win a global race for power and control.

Learning the lessons of history, insurers, banks, central banks, the FCA, governments and politicians must all cooperate to ensure agents do not repeat the chaos of previous financial crises. Yet cooperation seems in short supply.

We are at a cross-roads where the Western World may decide in time to control the harmful aspects of AI whilst at the same time deploying the beneficial aspects for the good of humanity. International cooperation is key to that process whilst in todays climate there has been a withdrawal from globalisation, rules based trading and an increase in protectionism.

“The 2024 US presidential election placed as the head of the world's leading AI superpower an administration that is allergic to government regulation, hostile to international cooperation and hell-bent on maximising its own power and creating a new imperial world order”.

Yuval Noah Harar

The current US goverment is empowering a small group of entrepreneurs to make what might be the most consequential decisions in human history. The Trump Administration has deconstructed self-correcting mechanisms, fired Federal Employees, gutted regulatory bodies and ceded power to tech billionaires and their comopany algorithms.

Trust is fragile to say the least; not just in the US, but in democracies. Populist politicians like Nigel Farage in the UK, Marie le Pen in France have no viable plan as to how Europe can leapfrog ahead in the AI race to AGI. China is determined to win that race. Trust is at a premium but diminishing. Harari describes this as the Trust Paradox.

The Trust Paradox

The race is accelerating because humans cannot trust one another. Anthropic's CEO, Dario Amodei,warns of the dangers of agentic AI and AGI whilst at the same time he cannot afford to allow OpenAI, Meta, or Google to win the race. He does not trust them. Trust is in short supply between the US and China, the US and China, Europe and Russia.

Can the very people who cannot trust each other trust superintelligent AI's without a consciense to make decisions for the good of humanity? We have proof that primitive AIs can lie, deceive,manipulate and pursue different goals than developers planned. Coming AIs will multiply that potential. Today, humans can ensure that outcome does not happen. That requires cooperation on a global scale just as was evident in the 2008 Financial Crisis and the Covid Virus Crisis that hit the world.

The UK could be in the forefront of this process.

Against this macro scenario the hype of the large LLM vendors hits the buffers of practical reality with the positive aspect of this narrative being UK Financial Services on the front foot and already a global leader. It could be a beacon of light with its history of global trading and global agreements. Starting in Financial Services and other sectors where the UK is a global leader, spreading across the whole economy and influencing governments in Europe, The US , China and elsewhere.

A noble mission to save humanity from the worst outcomes of AI and allow it to improve our physical and mental health, protect economies, protect the environment, and help us create peaceful and prosperous communities

Further Reading

Whose to blame when AI goes wrong? Fintech Singapore

Nexus- a brief history of information networks Yuval Noah Harari

Haters on the right and left are wrong about London The Economist

Don't be fooled - AI bosses are regular capitalists The Economist

Appendix 1 Rory Yates ‘manifesto’ in managing long term impact of AI

We need to look at the long term implications of AI - and that's exactly what the Financial Conduct Authority is going to do.

👉 “AI adoption in financial services also introduces growing risks, including sophisticated AI-enabled fraud and identity abuse, algorithmic bias, and opaque decision-making,” 👈 - Sheldon Mills

I think these are valid, and a couple of immediate things spring to mind:

🧩 Be agnostic to the underlying AI.

📴 Have a plan if you or something else switches it off. "AI as a Utility" will have the same implications as core-software built in the cloud etc. And potentially exponentially worse security implications as well. See some of my views on this same topic here: https://lnkd.in/e4ktwcaz

⏹️ You need to make human in control / human in the loop real. Control frameworks and other requirements like DORA will mean new ways of working, not just more AI for security. See ServiceNow's AI Control Tower, or speak to the team Calitii

🤖 Think human first. Harmony between people and machines is far more than a simple set of trade offs that too many make it out to be. And I think this sort of rhetoric misses out on the huge advantage thinking "AI for humans" delivers. Making things better, not just cheaper. Making things more interesting through creativity, not just easier to consume. Building in friction and time when it matters, not just bi-passing cognitive muscles when in fact you want deeper relationships. And so on.

Article in Financial Times: https://lnkd.in/eaygsgUn

Appendix Two: Current GEN Support Providers

DXC Technology - Primary support for GEN/Life-70 systems

: Specialist consultancies: TXP, SICS, Adaptik, FIS, and boutique firms

System integrators: Accenture, Deloitte, Capgemini with legacy practices

Yet Britain remains a place where ideas spark—in this lies its potential for revival. It is home to four of the world’s top universities. One, Cambridge, sits in the centre of the densest innovation cluster on Earth, according to the World Intellectual Property Organisation’s Global Innovation Index. This century Britain has created some 178 unicorns, reckons Dealroom, a data provider—more than France, Germany and Switzerland combined (see chart). Its venture-capital market is Europe’s largest. Consider three of Britain’s strengths: advanced manufacturing, life sciences and technology.

unknownx500

unknownx500