It is wise to remember that AI is not new. In 1956, the pioneers from Dartmouth College came together to establish what today is termed artificial intelligence (AI). 70 years later…….

You will find below: -

- Current viable use cases for narrow AI

- Two lessons from pharma companies

- The LEAP project and realistic timelines for AGI and ASI

- Artificial General Intelligence (AGI)

- Artificial Super Intelligence (ASI)

- Futher Reading including trusted partners

Current Narrow AI tools

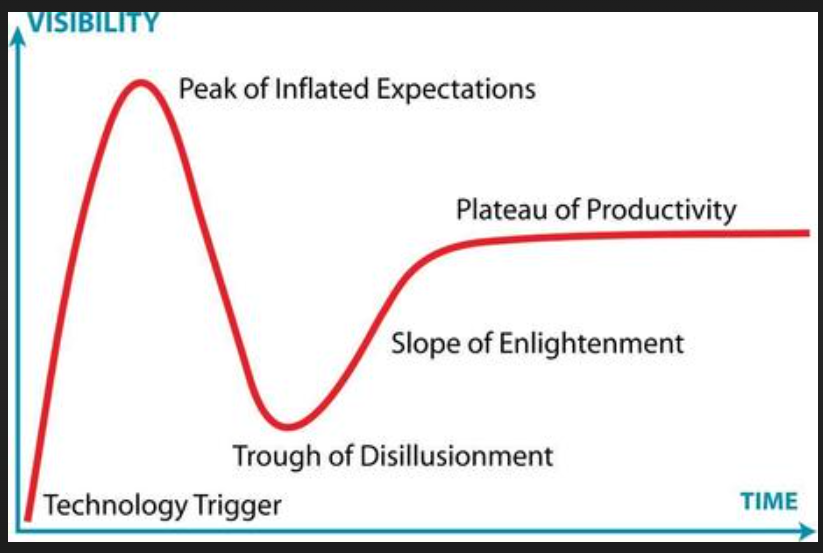

LLMs and GenerativeAI, not to mention AgenticAI ( I prefer to call them digital workers) have proved effective tackling boring, high volume, well understood and repetitive processes in the insurance and other market segments. Hype and reality have followed the Gartner Hype cycle.

The peak of ‘inflated’ expectations dipped into the ‘trough of disillusionment’ as initial ‘pilot purgatory’with vague goals and no measurable testing lead to disappointment and a retrenching to focus on real problems that would make a big impact. Some insurers are on the ‘slope of enlightenment’ and for those that have to yet to ascend that climb there are lessons to be learnt from drug making which is reaching the ‘plateau’ of productivity.

Insilico Medicine, a biotech firm in Boston, seems to have been the first to apply the new generation of AI, known as transformer models, to the business of finding drugs. Back in 2019 its researchers wondered whether they could use these to invent new drugs from biological and chemical data. Their first target was idiopathic pulmonary fibrosis, a lung disease.

They began by training an AI on datasets related to this condition and found a promising target protein. A second AI then suggested molecules that would latch onto that protein and change its behaviour, but were not too toxic or unstable. After this human chemists took over, creating and testing the shortlisted molecules.

Two lessons there-

- Training on relevant datasets (specialised language models) rather than the LLM approach that may include Taylor Swift's favourire music and lyrics or the drug habits of depressive yet creative musicians, authors or criminal gangs.

- Humans take over to manage and test all the assumptions and conclusions. Life and death matters in healthcare and Life & Health Insurance, and high compliance regulations make this essential

In the King’s Cross area of London, once dominated by railway yards and industrial buildings and now, after a makeover, one of London’s most achingly trendy districts, Dr Schwab works for GSK, a drug company. He reimagines the future of drugmaking using artificial intelligence (AI). He is applying this to transferring as much of the load as possible from glassware to computers: in silico drug design, rather than in vitro.

He is developing Phenformer, which he is training to read genomes.

Phenformer is a genetic language model that reads whole-genome sequences – analysing up to 88 million base pairs per individual – to predict disease risk and uncover molecular mechanisms. By linking genetic variation to biological pathways, Phenformer provides new insights into disease progression and supports data-driven approaches to personalized medicine.

This is the strength of SLMs and GenAI. Sifting through masses of relevant data and suggesting patterns, causal relationships and possible outcomes. But humans then take over to prove the validity of all conclusions. The results are impressive.

Insilco states it took 18 months to arrive at a candidate for development—compared with a more usual timeline of four and a half years. It now has a pipeline of more than 40 AI-developed drugs it is developing for conditions such as cancer, bowel and kidney disease.

Tie-ups between pharma firms and AI firms are also becoming common. In 12 deals were announced in 2024 , with a combined value of $10bn according to IQVIA, a health-intelligence company. And last October Eli Lilly, another pharma giant, announced a collaboration with Nvidia, the firm whose chips host the generative neural networks which transformer models rely on, to build the industry’s most powerful supercomputer, and thus speed up drug discovery and development.

Reports from across the industry suggest that AI has begun to deliver these. It has slashed the preclinical phase (that before human trials begin) to 12-18 months, from three to five years. And it has improved the hit rate. A study published in 2024, of AI-discovered molecules’ performance in early clinical trials, found an 80-90% success rate. This compares with historical averages of 40-65%.

The insurance industry is subject to high compliance, is hindered by by vast amounts of unstructured data being hidden, and after achieving cost reduction ( but still generally relying on the same processes) can also combine specialised SSMs trained on data relevant to the line of business and market segments targetted to shorten analysis times and hand human professionals summarised content and suggested proposals for the humans to select and test viable solutions to actually transform products and business models.

Whilst being sceptical about the hyped LLM vendors claims, surely unstainable business models ( will they ever be able to payback the current and planned investments and circular financing that look suspiciously like ponzi schemes?) and particulary to deliver general artificial intelligence (AGI) soon and Artificial Super Intelligence- ASI- (able to surpass human intelligence) within a few years the actual time spans will take much longer.

That is why the LEAP project caught my attention.

The Longitudinal Expert AI Panel (LEAP) sets out to do three things. First, rather than assessing vague claims about concepts like AGI, it offers specific, testable hypotheses. When will self-driving cars account for 20% of American ride-hailing trips? What proportion of the country’s electricity will be used for AI by 2040? What will be the benchmark scores for open-source and proprietary AI models in 2025, 2027 and 2030?

Ezra Karger, an economist at the Federal Reserve Bank of Chicago runs the LEAP project and will combine analysis and predictions from 350 experts from many different fields: -

Corporate AI analysts

Academic computer scientists

Economists

‘Superforecasters’ with a track record of being more accurate that experts

The results of the first round, published on November 10th, suggest AI’s impacts are just beginning to be felt. The median forecast has more than 18% of American work hours being AI-assisted by 2030, up from 2% in September this year. The forecasters expect that AI will account for about 7% of American electricity usage by the same year.

How about the longer term- 2040?

By 2040, they expect AI to be as important to this century as electricity or the car were to the previous one—a score of eight on a ten-point scale devised by Nate Silver, a statistician, designed to measure the impact of different inventions. They also thought there was a nearly one-in-three chance that AI might rank at least as high as level nine, where it would join technologies like the printing press as a technology that “changed the course of human history”.

A Forbes article by Douglas Laney ( very strong AI credeentials) ‘Beyond AI: Preparing For Artificial Superintelligence’ backs this up.

He includes this quote 'According to Andrew Ng, founder of Google Brain and DeepLearning.AI, "We are building smarter systems; despite all the hype and excitement about AI, it's still extremely limited today relative to human intelligence." '

Nevertheless Laney is a little more optimistic: -

The Next Advancement: Artificial General Intelligence (AGI)

Artificial general intelligence represents the next major technological challenge. Systems that perform all intellectual tasks that humans can accomplish through learning abilities and reasoning capacities to mimic human cognitive functions qualify as AGI. Mainstream agentic AI will emerge due to AGI technology when independent AI agents start orchestrating decisions and activities and working together as colleagues.

The arrival of AGI approaches sooner than many people anticipate, even though it has not materialized yet. AI researchers expect that the creation of AGI could occur this decade, according to their forecasts, but you would also expect them to err towards the optimistic time scales wouldn't you?

The business sector stands to face substantial changes due to the arrival of AGI. Current artificial intelligence stands apart from expected future artificial general intelligence because it will appear in the following way:

Manage complexity across functions. Systems using marketing insights together with supply chain data, corporate strategy, and macroeconomic forecasts will operate without any friction.

Enable new innovation models. The speed and creativity of product and strategic invention that AGI systems will exhibit surpasses our current understanding.

Transform workforces. The future demands job evolution and removes historically relevant occupations from the workforce. AI will take control of macro and micro decision systems together with routine tasks, although people will concentrate on human-based tasks that need social abilities accompanied by diminished manual positions.

Leopold Aschenbrenner outlines the consequences of increased system situational awareness in his study Situational Awareness: The Decade Ahead This suggests a more futuristic reality: "Once systems reach a specific level of situational awareness, they will predict outcomes and optimize pathways to objectives in ways that humans cannot understand or anticipate."

Laney continues: -

The Ultimate Achievement: Artificial Superintelligence (ASI)

The arrival of artificial general intelligence will trigger experts to predict the rapid development of artificial superintelligence through self-evolving intelligence systems. ASI brings forth machines that exceed all human intellectual capabilities to perform in every domain and generate new inventive areas. A perfectly gifted artificial general intelligence sets the stage for artificial superintelligence to emerge, which would function in ways that remain incomprehensible to humans. ASI promises to expose solutions for present-day impossible problems while developing revolutionary innovations that reshape economies as well as businesses alongside societies.

Laney advises business leaders to: -

Invest in AI literacy. The strategic aspect of AI surpasses concerns about managing information technology. Your leadership staff must grasp the functional boundaries of AI tools together with their future development patterns. Everybody within the organization needs adaptation abilities that let them work with AI technologies across their primary operational functions.

Balance bold experimentation with ethics. Leadership through ethical AI practices and governance and transparency initiatives will separate companies that stay ahead from those that fall behind, yet organizations need boundless exploration and experimental approaches to maintain market competitiveness. The perfect equilibrium between determined technological advancements and responsible management decisions ensures confidence-based fairness, which produces innovations that shape industry leaders.

Enable AI-human collaboration. Businesses should investigate how human interaction with AI systems integrates with machine-AI systems and collaborative human-machine-AI operational models. Despite the emergence of AGI technology, the most successful enterprises at this time will focus on enhancing human capabilities rather than replacing them by thoroughly investigating machine-to-machine compatibility to improve efficiency and safety while also creating opportunities for innovation.

Experiment now. Businesses that delay their adaptation to narrow AI before AGI and eventually ASI will find themselves trailing behind competitors. Your organization should actively search for emerging opportunities, after which you should test new business approaches and build adaptable systems that allow your organization to transition between new economic changes together with changing workforce dynamics and fresh market developments.

This the quandary facing business leaders today. The benefits of GenAI cover a narow field today and enterprises have cut back on early pilots to focus on compelling and viable use cases. But they must train and resource employees to levarage today'snarrow use cases and the next decade's broader deployment of AGI and ASI. It takes time to change culture, resistance to change and ensure the company has optimised its goals to reflect predicted future customer behaviour and unmet needs.

Even current narrow AI toolsmay suggest future outcomes in the same way drug companies have benefitted. But remember these tools offer probabilistic conclusions and NOT deterministic. It takes skilled professionals to test and choose viable projects and technology partners willing to collaborate through thick and thin times to pilot current and future AI tools to their limits so that insurers can ensure any deoloyment not only solves compelling issues but also meets seciurity and compliance regulations and intenarnal standards.

Rory Yates explains this well in his Adaptabilty posts; the latest one is on Macro trends to help see the wood for the trees. Too many people focus on micro-trands rather than the future that Laney describes. See further reading for Yates's six macro trends in insurance.

1️⃣ Reshoring and new partnership models are emerging

2️⃣ Embracing AI transitioning to more intelligent futures

3️⃣ Disruption will once again be a key word often used in the next twelve months

4️⃣ A resurgence of investment and innovation attention going back into claims

5️⃣ M&A will become increasingly focused on developing new propositions

6️⃣ CX & EX will count more than ever as a competitive differentiator

I will leaves the final word to Laney:-

The companies that prepare for these coming evolutions through intelligent adjustment will become leaders of tomorrow, although AGI or ASI remains a decades-long prospect. The dismissive approach toward new technology, like factory owners with electricity, will lead to businesses becoming obsolete.

"Machine intelligence is the last invention that humanity will ever need to make,” according to Nick Bostrom an AI ethicist at Oxford University. The lack of a guiding plan for the future concerns him, as we continue building it without direction.

Leaders of business and technology need to begin developing their path forward immediately.

Good luck and put the hard yards into juggling macro and micro trends.

Further Reading

Beyond AI: Preparing For Artificial Superintelligence Forbes Magazine

The Adaptability Newsletter Rory Yates on Macro Trends for insurers

An AI revolution in drugmaking is under way The Economist

Which Technology partners can you trust? see below: -

Which partners can you trust?

The list below is neither exhaustive and is based on my own engagement with the companies listed and having had to place my own job and reputation on the line managing a large $17million transformation project that delivered over target, under budget and only a little late.

Modern MACH architecture core and PAS platforms will be part of an integrated ecosystem in which data flows across the whole value chain. Insurers have mostly relied on the gorillas in the market but even modern legacy platforms will limit an insurer's ability to leverage AI fully.

The UK's FCA industry regulator has stated that the “regulatory foundations” for the first Open Finance scheme are to be in place by the end of 2027. Prioritising small business lending, “so these engines of growth can better access capital”. That perhaps gives insurance a chance to get ready, and lay some new foundations first.

The risk is that the industry is once again caught napping, and the potential left untapped. Seamless data sharing across the whole financial ecosystem like that laid out in the Centre for Finance, Innovation and Technology (CFIT) Blueprint report will require operational data models, and integration capability that doesn’t really exist yet in insurance.

This will take new insurance business models built on technologies that make this possible. MACH based, event data streaming and AI harnessed as needed. Change will need to happen across the industry, but I am confident this change will come.

Examples include (alphabetical order) : -

EIS- describes its deployment of AI for esure. Chief Strategy Officer Rory Yates is well known in the industry for his insights and advice, including the pros and cons of deploying all AI tools, including GenAI. Describes the success with esure on its website.

FintechOS- strength and focus initially on banking; now expanding into insurance and AI deployment. Scott Thompson is the insurance lead

Genasys- clients include Simply Health and many MGAs. Group CEO is Andre Symes; the CRO is Gavin Peters

ICE has many insurance customers listed on its website. ERS Motor Insurer, Ticker, Provident Insurance, The Hood Group (travel insurance). ICE is part of the Actuaris Group. CEO Andrew Passfield

Instanda has`` many insurance clients, including Vitality for its core platform and transformation services. CEO Tim Hardcastle and Group CRO Derek Hill

AI and Data Management technology partners that can steer you through the AI, GenAI, AgenticAI, SpacialAI and AGI journey of experimentation with safety and complaince as a priority:-

For larger Tier One and Two Carriers,Global Insurers, Reinsurers and the large global Brokers and emerfging large MGA groupings as US MGAs scoop up British MGAs

EY - proof is in the esure use case quoted on its website- Chris Payne heads up the insurance practice; you'll see him at many industry events

Service Now acquired Moveworks to extend generative and agentic AI. Able to scale and operationalise across the whole enterprise like EY. Nigel Walsh heads up the insurance practice

Capgemini publishes valuable survey insights and has partnered with AI-powered pricing and underwriting insurtech Hyperexistenial, which claims to validate every data source used to allow insurers to validate for adherence to compliance and regulatory standards before deploying. on July 7th Capgem announced the acquisition of BPO WNS Group which many Tier One insurers outsource parts of the value chain to. WNS has a strategic partnership with digital claims platform insurtech RightIndem to transform claims in a transformative ecosystem. Luca Russingan is the Capgem Senior Director, Insurance Intelligence.

Accenture acquired Altus Consulting, which analyses an insurer's digital maturity and how to fill gaps for future innovation- Mark McDonald heads the Insurance practice in the UK

BCG is well known, though I have no direct experience. It has shared the stage with with AgenticAI tools partner Kore.ai

KPMG- Hew Evans is Head of Insurance in the UK and Matthew Smith is the Partner for Strategy & Transformation and Global Claims Lead

Salesforce.com- acquired Informatica to deliver AI across insurers; good fit with customers of its CRM, Sales, SaaS, and marketing platforms

Publicis Sapient- growing its insurance customer base. Was the implementation partner that I chose in the hotel project from a short list, as they proved more collaborative and put skin in the game. Dan Cole runs the Insurance Practice

Hitachi Digital Services- Hitachi is part of a massive global implementer with strong experience in Building Management Systems (integrate with insurers for preventative maintenance) and strong AI and other capabilities. Stuart Reeder heads up the Insurance Practice

Palantir made its name and dizzying valuation delivering AI to governments, particularly defence in the USA and the NHS in the UK. Licensing a tad expensive even for Tier One insurers, but they offer some compelling solutions and a test-learn-iterate-prove culture and workshops. Value, as with the other partners I list,must be in the eye of the beholder.

CGI- well respected in government, CGI has ten of the top UK insurers as customers of its Ratebase Insurance rating and pricing platform , and its Underwriters Workbench. Darren Rudd is Head of Insurance and technology business consulting, and will listen to your requirement and be realistic about satisfying them.

PCW's insurance practice includes Automation, AI, and digital ecosystems: product design, underwriting, pricing, and claims.

Maarten Ectors - I first met Maarten when he was Chief Digital Officer at Legal & General General Insurance. He invited innovators to a 5 day workshop with the L&G Teams for 4 streams one of which was claims transformation. He rejected the RFP/POC process and instead wanted the innovators to present their solutions to The CEO and C-Suite Friday morning. One outcome was a team of well trained L&G claim handlers augmented by technology winning a Smart Claim award for L&G , satisfied customers and better GI ratios. Maarten transferred to L&G Group as Chief Innovation officer, won more innovation awards, and now runs AI start-ups. He can certainly advise and oversee large, medium and smaller insurers. His pace of innovation may be a challenge to the cautious! Currently founder of Greentic.ai an open source platform “To create armies of digital workers". Worth meeting

For Mid-Size Insurers Tier Three and smaller, Brokers and MGAs

Aiimi Limited; Aiimi made its name enabling Water Utilities locate and reduce water leaks by accessing unstructured data using its AI-powered data management platform that will also make data AI-ready. It counts the FCA as a client and Riverstone International as an acquirer of legacy books of business. JLR and The Cabinet Office are named clients. It names PwC as a business partner. The CRO is Mark Drayton

Kore.ai is a US-headquartered Agentic AI partner with a European presence and support in London. Johnson and Johnson and Morgan Stanley are two of many global clients. The Chief Strategy Officer is Cathal McCarthy

AI Risk: a community of innovators that develops and deploys AI. It has built an agentic AI platform for a broker and is demonstrating a production version of this. On its website an operational deployment is described in a case study. I have a feeling it's a smallish broker ( 6 or so humans). The CEO is stated as being unable to recruit key people (humans) and has replaced all with digital agents. I have a feeling that can work better for a broker or MGA, whilst large insurers data issues will be a challenge. AI Risk certainly advises large insurers so worth talking with Simon Torrance who is the founder and CEO

Outlier Technology Limited. A blog on LinkedIn caught my eye. 'The best thing a business can do is forget AI exists' - tech CEO I called CEO David Tyler and found he had delivered a major data and AI project for a large utility that had spent £4m on a POC to meet regulatory compliance demands by a fixed date- a real problem. The POC failed despite it being a technical success. That pilot purgatory in action! The human end-users found it useless and rejected the deployment. Outlier was retained to make it work and ensure the users embraced it, which they did successfully. Outlier can collaborate to deliver even large projects cost-effectively as long as you share domain knowledge and collaborate with all your stakeholders. Outlier can build out a test, learn, and iterate MVP process until you are happy with the result. Worth a chat with David and his team.

There will be many other potential partners- I have listed those I have personal experience with and those insurers have used.

Dr Schwab works for gsk, a drug company. His job is to reimagine the future of drugmaking using that similarly trendy branch of computer science, artificial intelligence (ai). He is applying this to transferring as much of the load as possible from glassware to computers: in silico drug design, rather than in vitro.

unknownx500

unknownx500