The Financial Times reported on the wet start to 2026, which especially affected Southern England. Some areas, like Reading, received rain for 32 consecutive days, which is the longest rain streak in over a century. A "strong and unusually southerly jet stream" was the culprit, per the Met Office.

FT also noted that the region is experiencing its sixth-rainiest January in over 200 years.

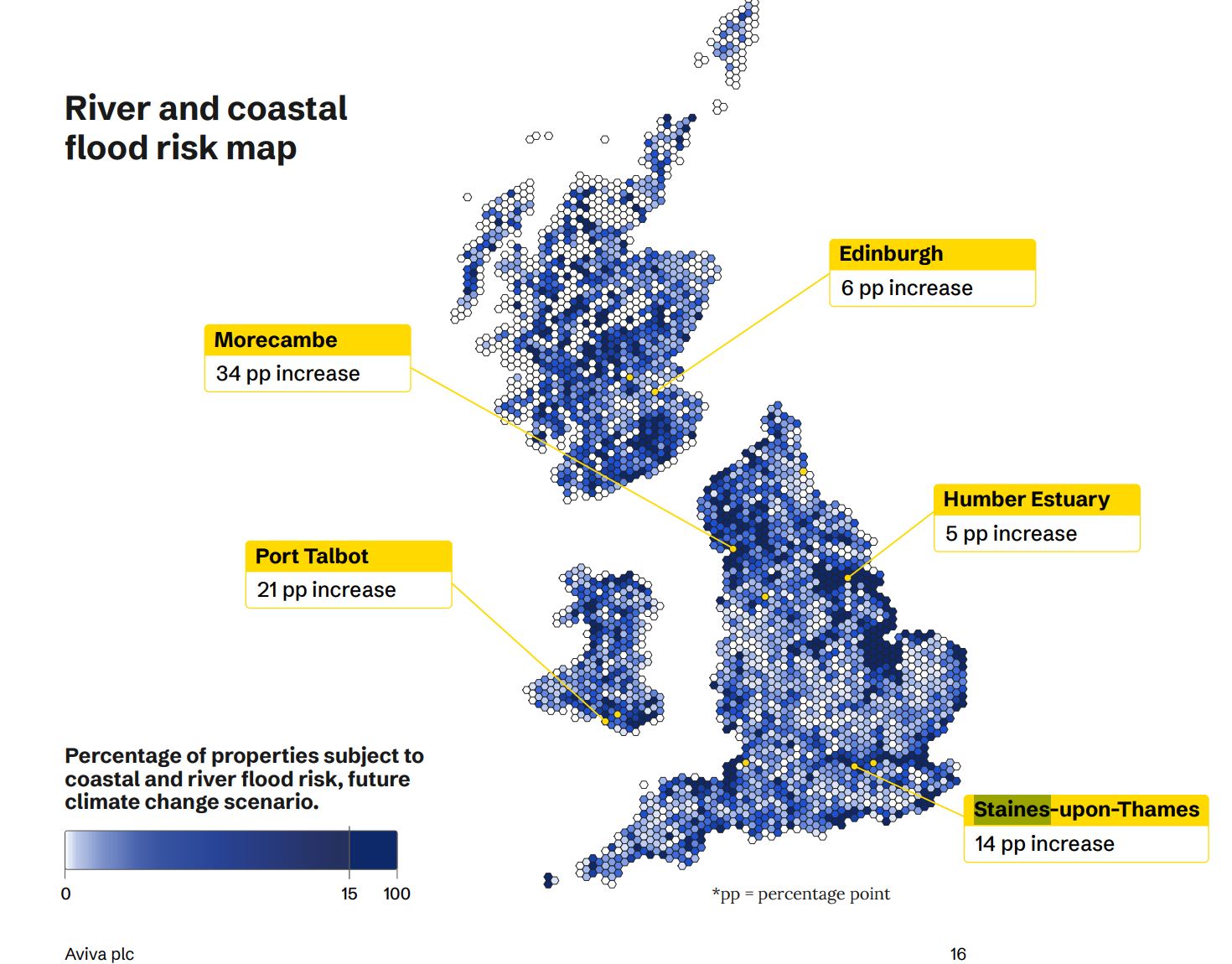

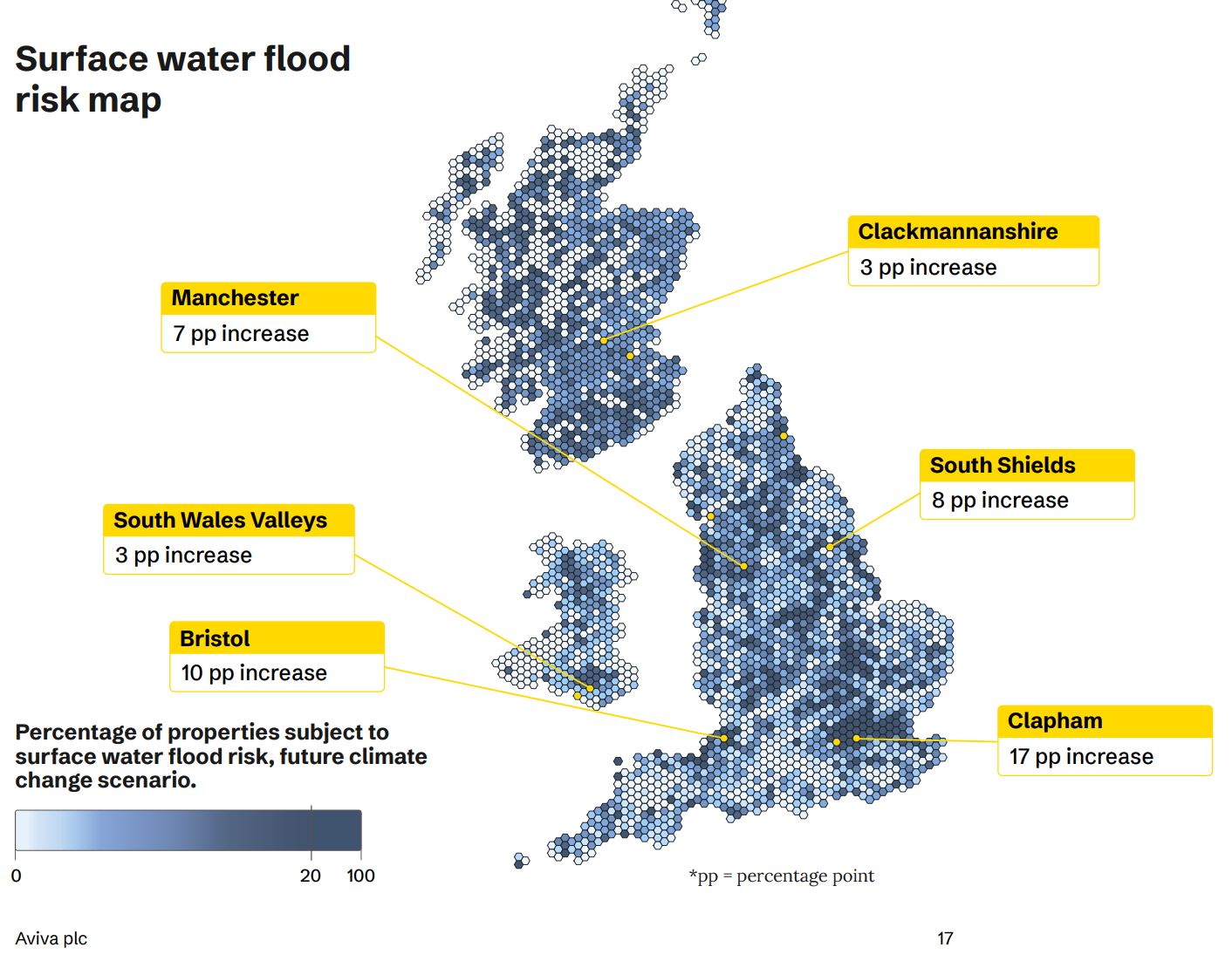

Aviva published a valuable and disturbing report on 18th February this year ‘Proportion of new homes built in flood areas rises to one in nine’. It pictures,literally, a worrying and increasing trend to build on high and medium risk areas.

It is not in just a few areas either.

Aviva summarises:

One in nine (11%) new homes built between 2022-2024 in areas at risk from flooding today[1]

Number of new homes at risk has risen from 8% over last three years[2]

By 2050 the number of new homes at risk will rise to 15% or one in seven new homes

Almost a third (30%) of new homes built in 2024 will be at some risk of flooding by 2050

Greater London and Essex have the highest number of constituencies with at-risk new homes

Aviva calls on Government to publish its own figures and strengthen planning laws

The report concludes with:

“In some areas, it will not be a case of if, but when, a home will flood. The strengthening of rules is crucial to ensuring homes are insurable in the future and to protect house values in areas where flooding is predicted. When flooding already costs the UK economy £6bn, where and how we build new homes is a growth issue."

“In addition to the potential financial challenges that homeowners may face, we want to help prevent the trauma and disruption that flooding can bring. We’re calling on Government to publish its own figures on the number of new homes in medium and high-risk flood areas and prioritise the prevention of further at-risk developments.

“Building new homes and locating them in lower risk areas are not mutually exclusive objectives. We must do both if we are to deliver sustainable economic growth and get ready for the future.”

Insurers cannot do this alone. Aviva is investing to support the Government’s plans to build more homes to help drive economic growth. Aviva, as a long-term investor in the UK[3], has already committed £25 billion over the next decade, including into social infrastructure, to support national growth and economic resilience. But HMG, River Authorities, Local Authorities, everyone must work together. This national situation is reflected elsewhere in the world.

Californian households buying and building homes in high fire risk areas. Australians building on land in which devestating fires can be expected. Climate change additional fire risk to the South of France, Greek islands.

The data is available to show where one should not build and where the risk is lower how to use the right building materials to defend against the unexpected.

Back in rain sodden UK the warning signs are highly visible.

One in nine (11%) new homes in England constructed between 2022 and 2024 have been built in areas of medium or high risk of flooding, according to new analysis from insurer, Aviva.[1] The analysis, which identifies new homes address data combined with the Environment Agency’s latest assessment of flood risk at constituency level[1], shows there is a worrying upward trend of new homes being built in high-risk areas in recent years. The data reveals that out of the 396,602 new homes recorded by the Ordnance Survey in England between 2022 - 2024,[1] 43,937 are in areas of medium or high risk of flooding. Over a quarter (26%), equivalent to 101,657, new homes have some risk of flooding.

unknownx500

unknownx500