2023 was a rotten year for Direct Line Group's CEO Penny James. Overall Net Insurance Margin (NIM) of -8.3% plus cancelled divident payments lead to James's abrupt departure and replacement by interim CEO Jon Greenwood until Adam Winslow was appointed to turn the company around.

NB: HI 2025 results have improved 7.6pp to a NIM of 9.4% over H1 2024 showing how Winslow and team did a good job before the acquisition by Aviva.

DLG was not alone amongst UK insurers as 2023 saw underwriting losses across the industry. EY has forecast the breakeven for 2025 and losses for 2026 after large premium increases in H2 2023 and 2024 saw profitability return. So it is timely to ask if UK insurers learnt the lessons of 2023?

Should motor insurers compete mainly on price leading to this profitability seesaw or should they focus more on anticipating customers' unmet needs and educating them on value-add services and risk prevention?

Or is that now a question that is too limited and now is the time that insurers should plan and strategise for the whole insurance value chain and not just sales & distribution, underwriting, claims , supply chain or digital payments?

I answer that question in these key sections

- 2023's adverse CORs are back again in 2026- danger for any more CEO's?

- Are insurers too focussed on parts of the value chain ratgheer than the whole?

- Are current systems and data holding insurers back from true transformation?

- Shouldn't insurers transform from commoditising insurance to the imagination economy?

1 2023 adverse motor COR may return in 2025

Note: Insurers started to move from COR to NIM in FY 2023 so please be aware I have tried to bridge the gap. As an approximate comparison:

COR to NIM approximation:

- COR of 100% ≈ NIM of 0%

- COR of 110% ≈ NIM of -10%

- COR of 90% ≈ NIM of +10%

The relationship: NIM ≈ (100% - COR)

NIM acccounts for the changing value of money over time. Motor insurance complex claims typically have long tails- two or even three years- so accounting for current and future value of cash flows is important

UK Motor COR and NIM Trends

The FCA, EY and Oxbow Partners have, amongst many industry advisers, published insights on trends in the British insurance market which I have combined in my own analysis.

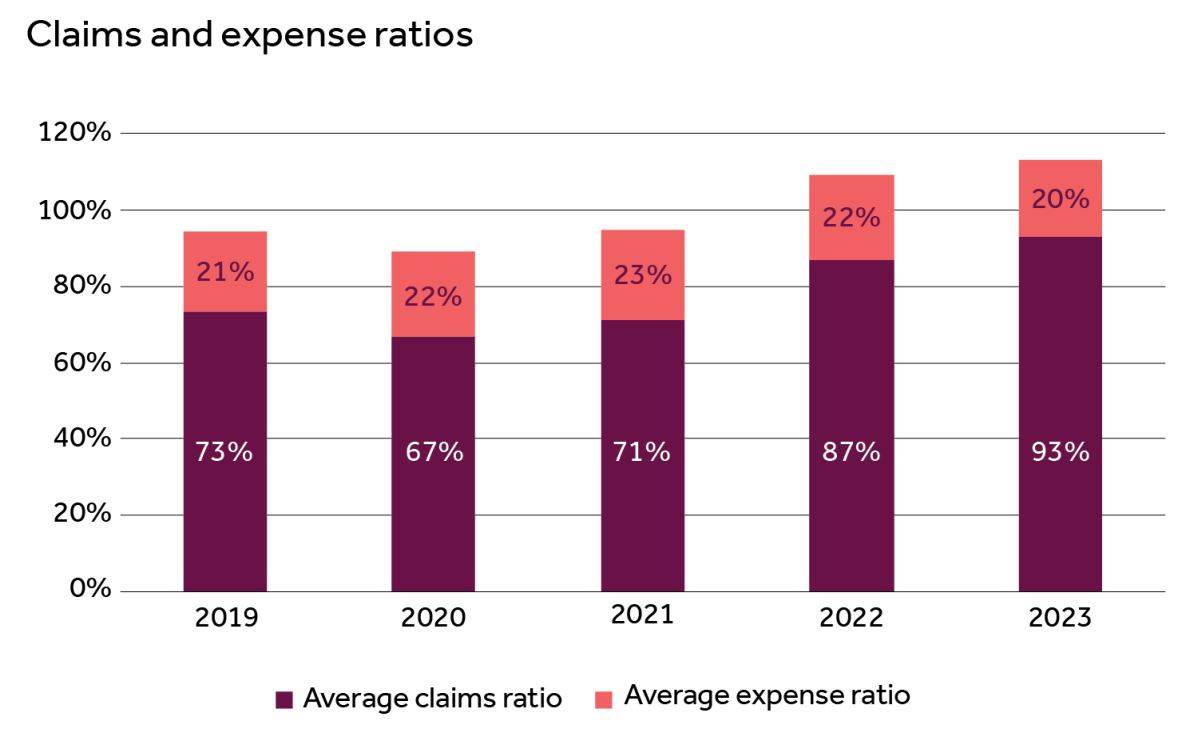

After the 2023 rising Combined Operating Ratio (COR) of circa 113% (FCA) and the exit of certain CEO’s bought to account by shareholders wanting profitable business outcomes, 2024 saw rising motor premiums and Net Combined Operating Ratio improvement to 97% (EY).

Oxbow partners predicted a profitable year for 2025 with a COR of 90% improving in 2026 to 97% whilst EY, in June 2025 forecast a break-even 100% COR for 2025 and a deterioration to 107% in 2026.

Admiral, Aviva, Allianz and Zurich have all reported improved COR for H1 2025 so the EY predictions may be off-beam and Oxbow Partners on the nail. Of one thing we can be sure, and that is predicting the future is not easy.

Particularly when one powerful individual, President Trump, can throw a spanner in the works with his erratic tariff policies as different countries please or displease him. We still have not seen the impact of tariffs on the US economy never mind the global and British ones. Exporters and importers seem to have sheltered US businesses and consumers from the inflationary impact until now, but tariff related disruption is one factor in claims inflation.

Motor insurance claims can have long tails so the current reserves may not be suffficient and when the final tallies made the COR be seen to have deteriorated.

Insurance Strategy and COR outcomes

The UK is a very competitive marketplace and the predilection of consumers to use price comparison websites is one factor leading to insurers competing on price rather than value.

The FCA data is drawn from “12 insurers with over 20 million annual policy sales, representing over 50% of the UK private motor insurance market. The quantitative data covered the period from 2019 to H1 2024. The sample included insurers of various sizes and with different business models and distribution strategies. It also included insurers authorised by the Gibraltar Financial Services Commission (GFSC). We believe the sample is representative of the market and validated this by comparing the average premium levels and trends with industry data for the review period”.

I would expect the major brands to be represented in those 12 companies with claims costs and expenses visualised below.

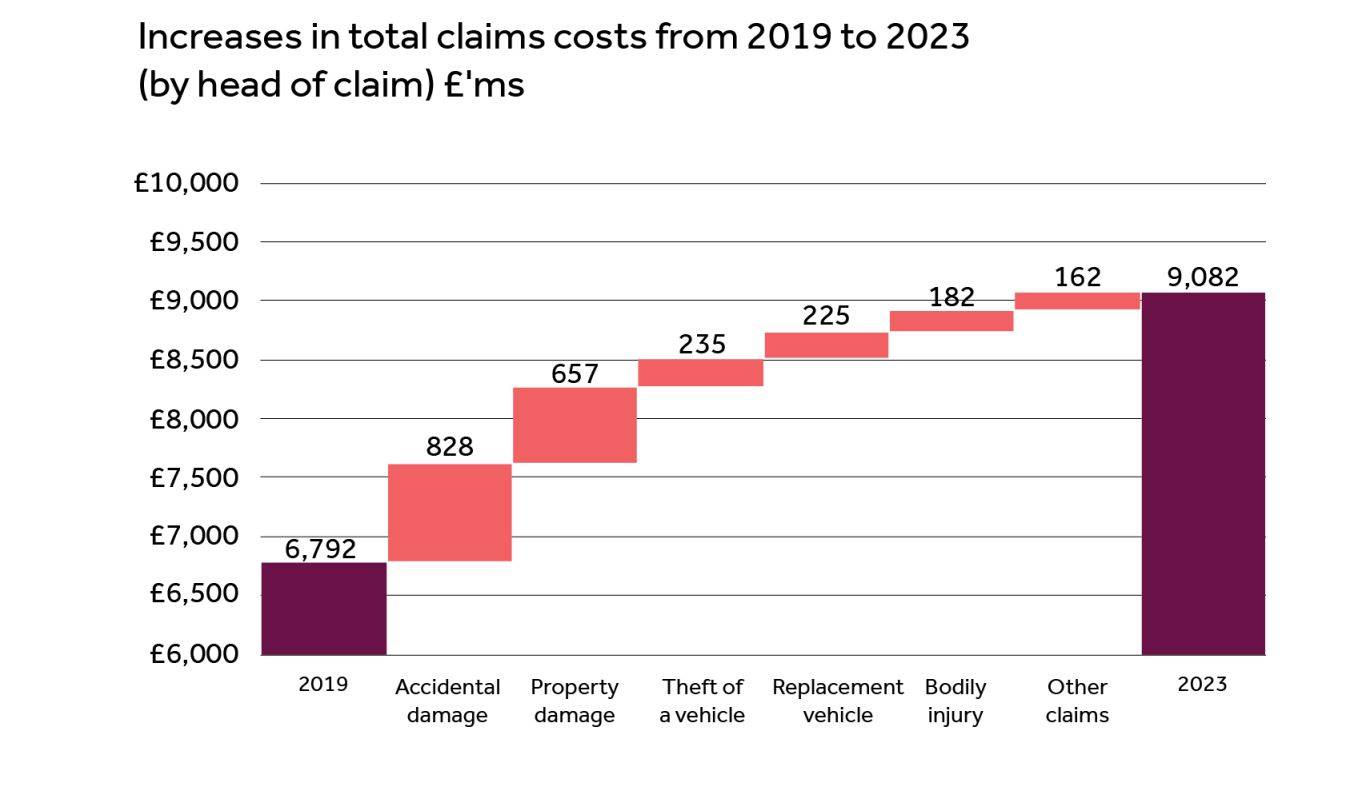

The FCA analyses these by major category though the long-tail claims of personal injury means that eventual costs may well differ from those reported. Note also that property includes both 3rd party claims for damage to vehicles as well as buildings, fences etc.

Accidental damage (First Party Claims) is the largest growth category, and we know that labour and parts cost inflation has added to this rise. The FCA is working with insurers and the government on actions that can help reduce costs across the picture above- see further reading in the appendix.

EY states in its June 2025 survey that “Following just one year of underwriting profitability in the last three, UK motor insurers are once again bracing for challenge in an increasingly uncertain market. The rapidly changing geopolitical, economic and regulatory picture, alongside increasing levels of consolidation, are posing very real challenges to motor insurers as they look to steer their pricing and portfolios. At the same time, lower premiums charged during the first half of this year are set to impact the bottom line.

“Despite this testing environment, insurers will be keenly aware of the need to continue to support customers with better propositions whilst carefully managing costs and delivering on regulatory commitments.”

The ABI in its August 2025 report on the motor insurance market 2025 states: -

“ABI members paid out £3.1 billion in car insurance claims during the second quarter of the year,4 maintaining the record-breaking level of quarterly payouts first reached in Q1.5

Repairs continue to be a major contributor to elevated claims costs - increasing by £100 million from Q1 to £2.1 billion.

Rising repair costs stem from a range of pressures. The increasing sophistication of today’s vehicles - featuring complex electronics, advanced sensors, and integrated systems - has made repairs more intricate and time-consuming. Broader economic inflation continues to impact the price of parts, materials, and operational overheads. Compounding the issue is a shortage of skilled technicians, which slows repair times - further inflating costs. “

The FCA, EY and ABI describe average outcomes so Insurers that do prioritise growth over profit by definition must have worse CORs. How long can they maintain these without raising premiums, reducing costs, and dealing with customer churn at renewal?

Some motor insurers apply overall strategy and their underwriting to achieve profit even if premium volume and growth declines. Sabre in its H1 2025 results reports: -

- 2025 HI COR 82.6%

- 2024 HI COR 86%

Credible in the market conditions of 2025. Sabre’s premium revenue is down 20% YoY, but its profit (EBITDA) is up 26% YoY. A different approach focussing on profitable customers. See appendix further reading for a link to Sabre’s published results.

2 Are insurers too focussed on parts of the insurance value Chain?

Motor insurance in some ways seems stuck in the past- customers want a level of risk cover but rarely read the actual small print to understand what is in and out of cover. Some insurers make a better job of explaining cover in understandable English backed by visual clues. Customers buying via PCW channels tend to go for the headline price, especially as UK core inflation is still high.

The uptake of telematics and tailored cover adjusting to actual driving behaviour is less advanced than in Italy and the USA. Matteo Carbone Founder and Director of the IoT Observatory publishes valuable insights on the adoption of telematics and development of usage-based motor insurance tailored to driver profiles and behavior. Adoption is slow whilst that is so for all new technologies as incumbent insurers experiment, test and take time to adopt strategies and the vital change management to deliver innovation. Such transformation is hindered by customers more interested in price than value and insurers unable to explain the benefits of such products or possibly not developing products that hit the real needs of customers.

AI in all its guises is not a panacea either. Creativity and imagination combined with business acumen are the preserve of humans; not of large language models trained on past and current data and predicting from what has happened not what the future holds for insurers and customers (see further reading).

Insurance Claims

Not just motor insurers but all lines of business. It is not unusual for an insurer to choose digital FNOL to speed up the reporting of claims, triage to the right internal claims teams and reducing costs by automating routine, mundane tasks feeing up time for claims handlers to deal with higher value issues. Digital adoption by customers remains stubbornly low however and once costs have been reduced how does that impact customer satisfaction?

Straight-through-Processing (STP) has long been touted as the end game of eNOL platforms but remains a hope rather than a practice for most insurers. Accidental damage to vehicles should be a prime target (back to the FCA data pictured in the 2nd image above) but human intervention is still necessary.

Generative and Agentic AI are touted by many AI Labs as the means to advance claims faster but in reality, and across all industries, they are at best tackling mundane issues today rather than ground-breaking transformation ( see Further Reading Appendix)

Digital Underwriting

Digital underwriting is being adopted by insurers, P&C and Commercial, to get pricing right, and free up underwriters from peering at spreadsheets for 40% or more of their week and free them up to work with distribution and claims teams.

Technology is a means to an end and not the end itself. Over the last decade the technology ‘solutions’ like those mentioned and sold actively to all insurers remain point solutions. Improving a part of the value chain may just pass bottlenecks to another part of the value chain.

Ecosystems

Much is being written of ecosystems; just like the term AI, ecosystems can vary from two interconnected systems to a whole inter-connected enterprise where the sum of parts is the total company and not just distribution, underwriting, claims, payments, supply chain management and restoration and/or replacement.

Prevention rather than just mitigation

Prevention requires far more than just insurers. The poor people who suffered loss of homes, businesses, health and injury in the Californian wildfires are still in many cases waiting for claims to be processed. If future such events are to be avoided then rebuilding must include preventative measures that anticipate climate change, fire and flood. Insurers need to work with Federal and State (National & Local) government, developers and builders, construction industry suppliers and all stakeholders to prevent risk. Insurers cannot carry the burden alone.

Motor insurance will be impacted by demographic changes- increasing urbanisation, ageing populations, evolving mobility needs for example. Uber, self-driving cars and robotaxis are all being anticipating these changes with experimental trials appearing in cities in the US, Europe, China and Asia.

IMO this adds to the need to think holistically across the whole business and not just by line of business and sub-elements within these.

What of new entrants to the market?

Insurance is a highly regulated market, so incumbents have a defensive protection from newcomers. Successful companies like Flock tend to serve market niches like fleet rather than the general market.

Having said that incumbent Admiral Group has, through its venture building business Admiral Pioneer, teamed up with Flock: -

"Flock, the London-based Insurtech scaleup, has entered into a new partnership with Admiral Pioneer, Admiral Group’s venture building business. This collaboration aims to transform UK fleet insurance with advanced technology and real-time risk management solutions.

The partnership will empower Flock to expand its offering and support a wider range of fleet customers. The initial rollout will target courier fleets, business fleets such as tradespeople and service vehicles, along with short-term rental companies. The new product will be available to customers directly and through its growing network of trusted brokers. This expansion ensures that more fleets can benefit from Flock’s innovative solutions and Admiral Pioneer’s insurance expertise."

Admiral has just reported H1 2025 results and an improvement in motor insurance profitability: -

"In the UK, car insurance prices have been falling for the last 18 months due to softer inflation. Our disciplined approach to pricing and growth means that we reported a great performance across the board. Our UK Motor business increased its profit by 56 per cent …”

Aviva also reported on 14th August a H1 2025 improvement of over one percentage point to 94.6% and for DLG which it acquired ( but not in the H1 Aviva figures) an improvement in H1 NIM of 7.6pp to 9.4% .

I wonder where this leaves other UK motor insurers?

4 Are insurers held back by Data & Systems

Most insurers are tied to systems that either have a high mix of legacy (rows of AS400s still humming away) and what I have turned ‘newer legacy’ like Guidewire. That makes it harder to focus on the customer rather than the policies.

Newer MACH architected platforms like EIS and Genasys are enablers of a customer-focussed strategy, but it takes courage, vision, time and money to migrate to these. Especially as M&A activity by the larger insurers has resulted in different technology stacks in each country and business unit.

Modern AI tools and technology partners can help bridge the gap but only if insurers know the challenges they need to face and change, why and work with the right partners to decide how and when.

Data lies at the heart of this approach, in fact at the heart of any approach. Relevant, timely, real-time, internal and external. Data from siloes, hidden in policy admin systems, core platforms, from government and emergency service. The list is enormous, and the data must be constantly replenished and cleansed.

That data will power innovation across the whole business and not just one part of it. Succeeed in one early area and you can more confidently innovate across the whole business.

4 Transforming from commoditisation to the imagination economy

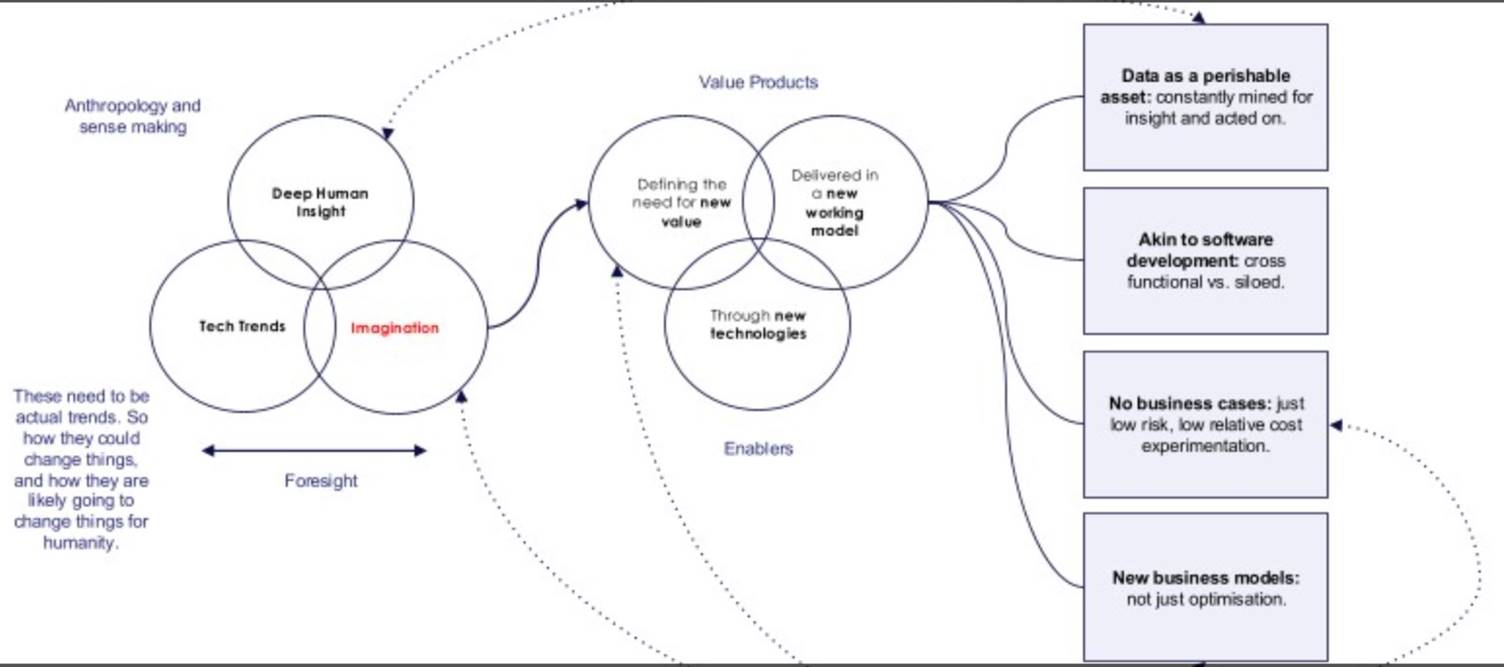

I have lifted the ‘imagination economy’ idea from Rory Yates CSO of EIS.

Innovation needs to be tackled across the whole organisation, with stakeholders, shareholders and customers. It is too late to be blinkered and focus just on today’s motor insurer customer. That customer has needs across Life & Health, Homes and Property, Businesses, Pets, Travel…… Without understanding how these all interact and how changes in the climate, geo-politics, trade, population ageing not to mention unforeseen risks like the financial collapse of 2008 or Covid strike the world then insurance will not adapt.

I’ve come a long way in this article from just considering motor insurance, customers buying on price and value-add innovation. We might address those issues for now but at the same time start putting the larger picture into planning. AI will not solve this, nor Agentic AI but will be a part of the solution.

Back to Rory Yates in which he stated (to paraphrase it)

“ …. help define what a better for humanity outcome might look like. I'd much rather have you by my side in this than one of these overly AI invested lunatics we seem to be surrounded by!!

And I think we are potentially entering the imagination lead economy, if we do this right. Now that could be really exciting. However, we must purposefully and collectively make it happen.

Rory visualised these by quickly adapting a slide he had.

Imagination and creativity are the realm of human beings who can make the imaginative leap from the tried and tested to the future. AI summarises what everyone is saying, writing and thinking today.It is an average prediction and not a top decile quality leap of imagination.

Thw ‘Wisdom of Crowds’ can be safe on known facts like ‘When was the Battle of Hastings?’ But ask ‘ How can we achieve a fair and sustainable peace between Ukriane and Russia, or Hamas and Israel’ will struggle

That is why I believe that technology solutions must augment and enhance humans rather than replace them to deliver better solutions for humanity.

Start with motor insurance customers by all means but at the same time do not be limited to this part of the market.

Mea Culper- I might have banged on about digital claims transformation in the past, but I have my eye on the big picture now!

Further Reading

UK motor insurers expected to only break even this year and dip into the red in 2026 EY June 2025 study

Motor premiums fall - but repair and theft costs keep revving up claims ABI report

Motor Insurance Claims Analysis FCA July 2025

Oxbow predicts profitable motor market CORs for 2025 and 2026 Insurance Age May 2025

AXA’s CEO on Insurance as a Tool to Drive Positive Impact

New emerging risks, insurers, and how technology can help prevent & mitigate risk Insurtech World Aug 2025

SONAR 2025 New Emerging Risks from Swiss Re

The aging demographic pivot demands strategic P&C insurance transformation Insurtech World May 2025

UK motor insurers on track to break even on underwriting this year with an NCR of 100%, following profitability in 2024 The industry is expected to face losses in 2026 with further premium increases required to cover persistent claims inflation Premiums forecast to fluctuate over the next two years, but consumers expected to pay net £10 less over the period

https://www.ey.com/en_uk/newsroom/2025/06/ey-latest-motor-results-analysis

unknownx500

unknownx500