To a western observer it is astonishing to see that Telco Safaricom, via its wholly owned subsidiary M-PESA, using basic phones and zero banking infrastructure, now processes half of Kenya's GDP. Kenya's 46 commercial banks lag behind in payment innovation whilst M-PESA delivers innovation in digital spades (apt pun for farmers wishing to sell crops and receive money digitally).

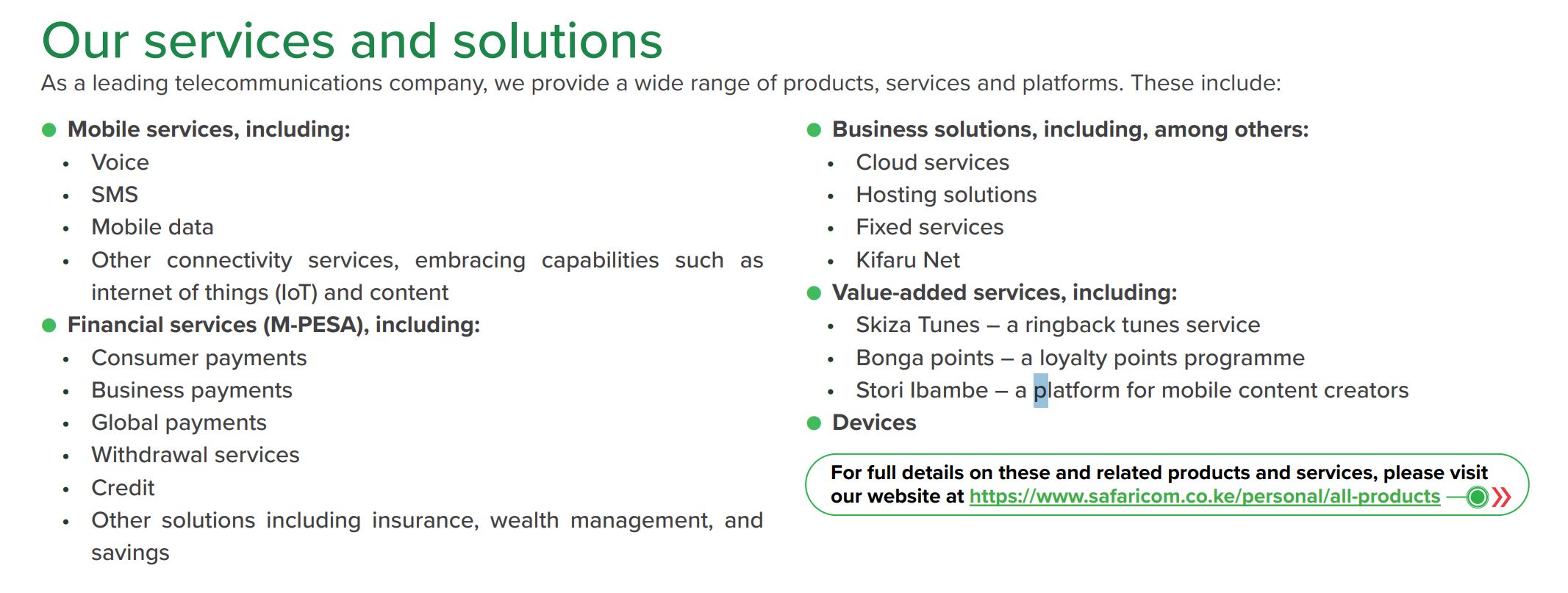

Safaricom not only covers Kenya with its mobile networks, 5G internet services; it provides a wide range of financial services from paying for matatu journey fares to purchasing goods from retailers and wholesalers, to providing credit for consumer and business customers

In Kenya, Safaricom and its subsidiary M-PESA already offers a payments platform and its customers already accept mobile money as a way of life.

In Ghana, MTN delivers similar services with over 28 million mobile subscribers and 17 million Mobile Money users.

Bear that in mind as we look at high income countries and the recent Google announcement of its Agent Payments Protocol, AP2. This raised great interest last week for enterprises planning to leverage digital workers. High-income nations have the infrastructure, ecosystem and (current) acceptance of high transaction costs to leverage AP2 but low and middle-income countries typically bypass banks and rely on mobile money, cash and Telcos. This article argues the case that the unmet insurance needs of over 1.4 billion consumers mean that Telco’s are the natural partners for insurers that plan to mitigate and prevent risk for this audience.

These markets completely skipped the traditional banking evolution. The World Bank's Global Findex Database shows 1.4 billion adults remain unbanked, concentrated in regions where mobile money already dominates. Rural Colombia never built bank branches. Nigerian villages never installed ATMs. When mobile payments arrived, people switched from cash directly to digital money without the friction of changing established habits. For personal and business use digital money is already a key factor of life.

Telcos are already in a strong position.

"The mobile industry has never been more important to the world's citizens and economy," says Mats Granryd, Director General of GSMA. "Mobile money is a game-changer for the financial inclusion of women and other underserved groups. It provides a gateway to a wider range of financial services, including savings, credit, and insurance, which can help people build resilience and improve their livelihoods."

When will there be an equivalent platform to Google’s AP2 that is viable for Africa consisting of 54 different countries, each with its own regulatory environment, its own currency, its own challenges, and its own opportunities? You can't have a one-size-fits-all approach.

With Telco’s success as mobile payment providers in these regions, such a platform could extend their services and revenue opportunities as long as it can work on smartphones, current infrastructure and with compelling apps and user interfaces.

Telcos in Latin America and Africa are building something new, using the phones already in their customers’ pockets. Some telcos and innovators will own this transformation while others will spend years trying to catch up. Safaricom is in a leading position already.

Mobile money is a start but what is required for a fully fledged ecosystem that telcos and insurers could leverage?

Let’s summarise what Google’s AP2 promises for high-income nations.

AP2 (Agent Payments Protocol) is an open, interoperable protocol built on top of existing agent standards like A2A (Agent-to-Agent) and MCP (Model Context Protocol). It provides a “payment-agnostic framework” for secure, agent-led commerce, supporting multiple payment types including cards, stablecoins, and real-time bank transfers.

Google has aimed this eCommerce protocol at the market for agents, or digital workers and at regions where the infrastructure is well developed and aims to deliver: -

- Enhanced trust

- Reduced fraud and disputes

- Interoperability across multiple vendors

- Support for agent led transactions as well as human oversight.

- Innovation platform for user experiences across networks

Nevertheless, time will be required to address key challenges including: -

- Regulation and legal recognition across countries with different compliance rules

- Security and privacy concerns- agents and digital workers are currently mainly appropriate for simple, well understood processes

- User experience- managing wallets today is not a simple UI

- Merchant and payment integration investment costs

- Resultant high transaction costs

- Crypto and stablecoin adoption lead times

Google may expect to tackle these in the developed nations of North America, Europe and parts of Asia. Customers, banks, payment providers and merchants are already used to paying high transaction costs.

But what about these low-income and middle-income nations?

Unbanked users are already comfortable using digital mobile money; in parallel with cash of course. They also need insurance, loans and the means of paying and receiving digital money for both personal and business use. Parametric and embedded insurance are just starters in this market. Patrick Kelaghan has already helped local insurers in various African countries scale up services designed for local people so when he brought such a company, Motisure, to our attention, I took notice.

The CEO, Joel Macharia, writes;

“Stop trying to "bank the unbanked." Start understanding them.

We keep throwing banking apps at matatus (colourful buses and large transportation industry in Kenya). They keep using cash. Why? Because our "solutions" solve our problems, not theirs.

What if we stopped building for them and started building with their data?

Imagine:

1. A matatu/bus that approves its own loan for new tires based on daily revenue.

Insurance that gets cheaper when drivers drive safer.

2. An AI that knows a operator is ready to buy a 2nd vehicle before they do.

3. This isn't fantasy. This is Agentic AI—and it’s the missing layer that makes embedded finance actually work for Africa's informal sector”.

You can see such financial services, including insurance, at [app.safirisure.com and https://motisure.com

Joel says “At Motisure, we're building the intelligent engine that turns real-time transport data into automatic financial inclusion. We're creating the system where:

✅ Banks/MFIs de-risk lending to "unbankable" businesses.

✅ Operators get capital & insurance without the paperwork.

✅ Everyone wins because the AI does the hard work.

We're looking for the rebels, the innovators, and the pragmatists:

- Banks tired of the same old credit models.

- MFIs wanting to tap into the $40B transport sector.

- Tech builders who believe data beats dogma.

So, the innovators are already at work.

In Kenya, Safaricom and M-PESA proved it. One telecom company, using basic phones and zero banking infrastructure, now processes half of Kenya's GDP. GSMA's 2024 Mobile Money report shows global mobile money transactions exceeded $1 trillion, with Africa handling 70% of that volume.

Where is the platform like Google’s AP2 for local markets across Africa and Latin America? That would embrace innovators like M-PESA, Motisure, Safrisure and insurtechs attracted by this huge market potential. Built to the needs of local peoples and businesses.

David Chaum, the inventor of digital cash in the 1980s and creator of the encryption that protects modern transactions, warned about surveillance capitalism decades before Facebook existed.

“I always envisioned the winning triple-play that cryptocurrency could be," Chaum says. “A win for consumers, telcos and retailers.”

The last quarter of humanity joining the digital economy won't wait for JP Morgan Chase, Citibank, HSBC, or Deutsche Bank to notice them. They're building something new, using the phones already in their pockets. Some telcos and innovators will own this transformation while others will spend years trying to catch up.

Where does this fit in your strategic thinking?

As of 2025, Kenya’s 46 commercial banks remain robust despite lagging in payment innovation compared to others. Major players include Equity Bank, Kenya Commercial Bank, and NCBA Bank, which dominate the market. Given the ever-present competition from M-Pesa, the banks seek to differentiate by enhancing customer experience through their digital banking solutions and personalised services, whilst continuing to streamline operations and reduce costs. Other actions being taken include:

https://paymentsafrika.com/kenyas-payments-shift-m-pesa-and-telcos/

unknownx500

unknownx500