Consumer Intelligence ranks UK insurers by direct customer experience rather than the opinions of industry pundits making it more objective. Its Insurance Behaviour Tracker (IBT) surveys nearly 50,000 UK home and motor insurance customers to give credence to the results.

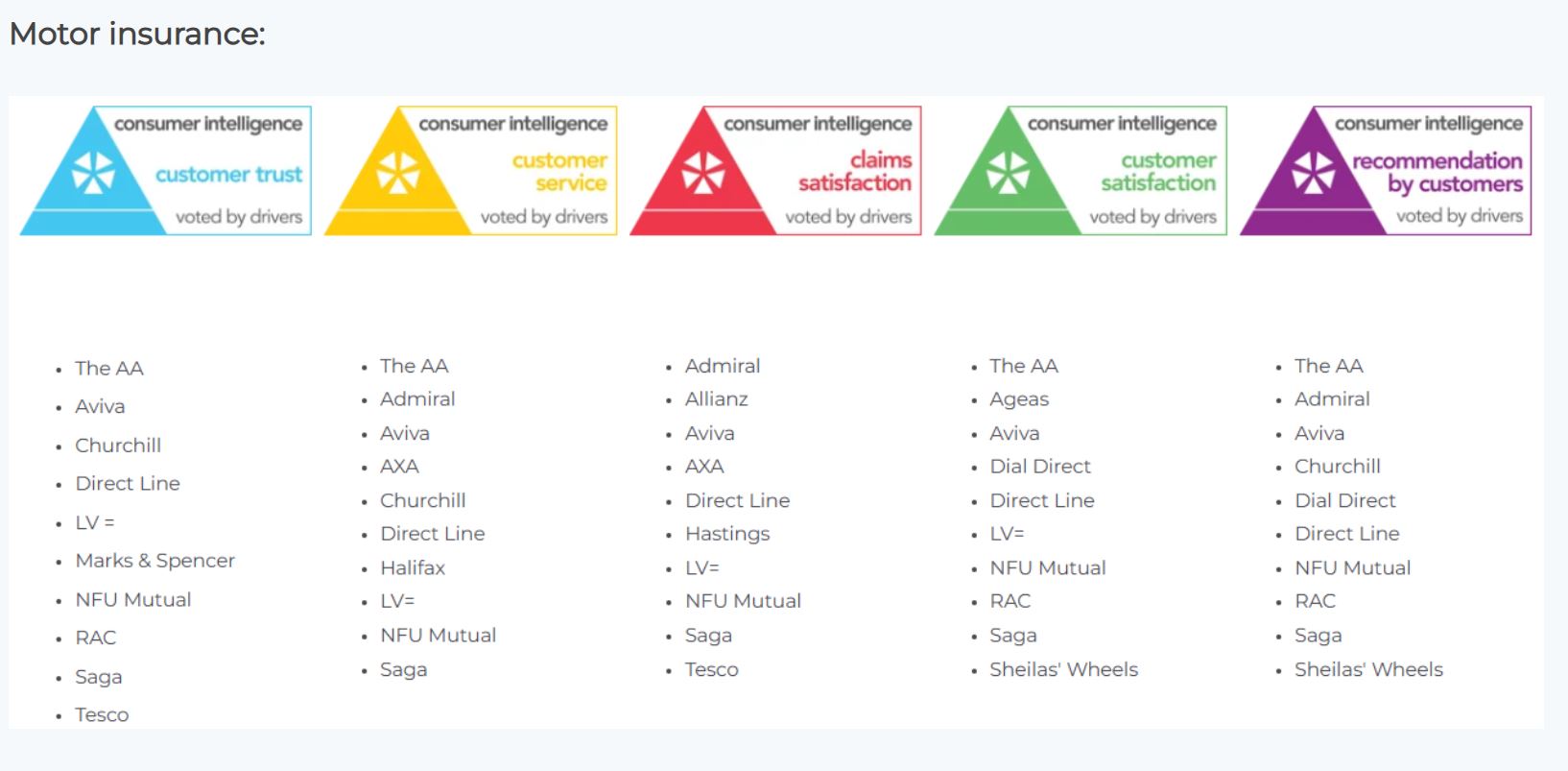

So what are the results? (Note: companies are listed alphabetically and not by performance but are the ‘Top Ten’ in each category.

Consumer Intelligence says “The winners in these categories represent the gold standard in the industry, securing their place as the UK's best-ranked insurers". That makes the Aviva acquisition of Direct Line very pertinent as both (plus DLG's other brands in the lists) feature in all categories for Motor and Home.

That implies serious competition for the others unless the merged duo suffers acquisition digestion pains.

2023 into 2024 was a bruising time for consumers whose renewal premium rates soared leading to increased complaints and shopping around. Interesting to see that the listed brands broadly retained the consumers' trust to recommend them.

How much of this is a case of overall industry inertia and consumers buying on price and via price comparison websites? And the hobbling of insurers to policy admin systems/core systems that make carriers policy-centric rather than customer-centric?

Capgemini has published some useful reports including:-

Note: See the Further Reading section below for a link to these reports

It takes years to innovate significantly and most multi-line carriers are held back by inflexible and complex core and PAS systems. Those that have decided to completely re-platform to modern, customer-centric MACH architected systems are now seeing the results e.g esure (Shiela's Wheels) and The AA .

I am looking for signs that such visionary strategies and technology investments push these carriers up the rankings in the 2025 and 2026 surveys. Not to mention new entrants to the market. It takes time though as change happens, as has been said; gradually, gradually, and then suddenly.

The devil is always in the detail. To make full use of these lists requires granular analysis to explain why each insurer is in the top ten and why others are in 11th place and lower. No doubt one of the motivations of Consumer Intelligence is to publish top-line results. Contact them to be able to access the detail.

I recommend looking at the Altus Digital Bar which has been ranking UK insurers in terms of how well they have implemented technology to improve customer service. An industry view to compare with consumers' feedback on total customer experience.

The same incumbent insurer brands have been in these ‘Top Ten’ lists for many years. That is the current nature of the market protected by strong regulatory constraints and customer inertia. Things are changing though as unmet needs and under-insurance cover drive consumers to become more demanding.

Further Reading

Insurance risks across market segments

Insurers Can Parlay Technology into a Competitive Edge- but too many don't!

Capgemini ‘Insurance Top Trends 2025’

The results are in! The highly anticipated 2025 Consumer Intelligence Awards have revealed the top-performing insurers in the industry.

unknownx500

unknownx500