I write NOT as an expert on GenAI, AgenticAI nor AGI ((Artificial General Intelligence) in which AGI outperforms humans changing the whole world of business, public sector services, education and jobs.

I am, however, encouraged by the findings of a survey of pundits and experts which found that that a chimpanzee throwing bananas at four decision options sccored higher than industry or sector experts ! Seriously YES. You can see a summary of the study here. and buy the book. I scored higher than the chimps and the experts. Why not try it yourselves?

That's why I offer my insights below with some confidence. that they have value to stimulate thought and discussions whether or not you agree with each section and conclusion.

LLM and AI vendors OpenAI, GoogeDeepMind, META and Anthropic all profess to deliver safety in each release but at the same time are in a race to be the first to AGI . Meta’s boss, who has rebranded its AI work as “superintelligence labs”, is poaching researchers with nine-figure salaries and building a data centre the size of Manhattan, dubbed Hyperion, which will consume the same amount of energy in a year as New Zealand and rapaciously seeking new funding all the time to get there.

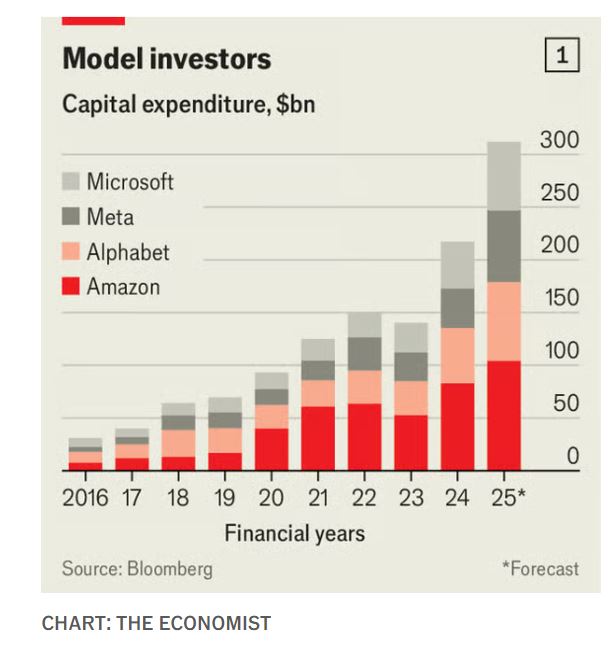

The investments of all big Western tech firms are soaring, driven largely by AI (see chart 1 from The Economist

It is a explosive mix of the cloud service providers investing more and more in AI Labs and hedging their bets. What happens if they loose faith in any one AI Lab? That drives each AI Lab to speed up the race and might compromise safety. That puts insurers in a quandary about meeting compliance ruled over by regulators and their own security policies.

This article can be read in parallel with Will GenAI and Agentic AI transform insurance claims management for insurer's competitive advantage? Whilst focused on claims it is as true for the complete insurance value chain.

I cover the following topics: -

- The AI race for Artificial General Intelligence (AGI)

- Barriers to GenAI & AGI Adoption by insurers

- Impact of AGI on the Global Economy and jobs

- Which Insurance use cases will deliver compelling outcomes?

- Which partners can you trust to guide you through this disruptive journey?

- Appendix Further Reading

1 The race for Arificial General Intelligence

There are what the Economist describes as “Four Horsemen” which profess to deliver GenAI, LLMs, AgenticAI AND safety.

- OpenAI

- Google Deepmind

- Meta

- Anthropic

The question is whether they are four high-bred pedigree vendors or the Four Hosemen of the Apocalypse?

It has been common for new technology to spread moral panic; think of the Victorians who thought the telegraph would lead to social isolation or Socrates, who worried that writing would erode brain power. But it is unusual for the innovators themselves to be the ones panicking. And it is more peculiar still for those same anguished inventors to be pressing ahead despite their misgivings.

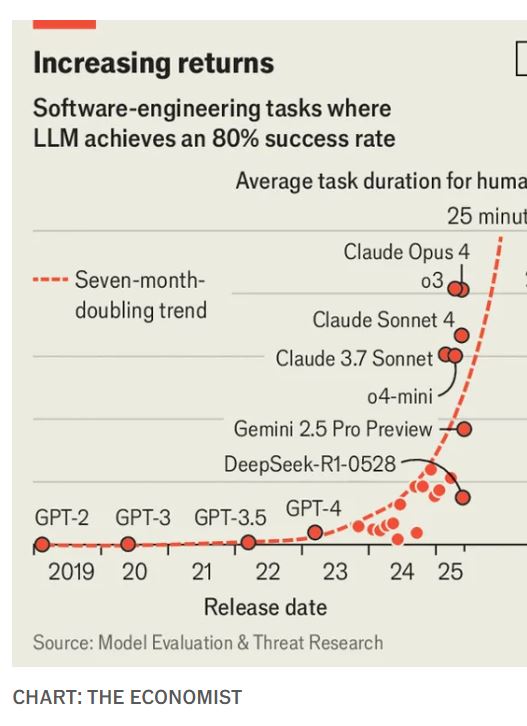

GenAI, AgenticAI and AGI are the latest in a long line. Geoffrey Hinton predicts a 10% to 20% chance of the extinction of the human race. At the very least many jobs will be replaced though current experience by Klarna which after deploying GenAI terminated 50% of its staff but then had to rehire many does indicate it will take longer. The race for AGI continues spurred by the rivalry between the USA and China to be number one nation to operationalise AGI. In April this year the AI Futures Project (AFP) forecast that by 2027 AI models should be able to run programming better than programmers themselves.

The AFP asked professional forecasters and biologists when an AI would be able to match top team human virologists. The median biologists said 2030 and the median forecaster 2031. So the professional role holders were more aggressive in their predictions of the speed of AI advances.

The current innovation and deployment trend has been faster that forecasters predicted. See this chart from The Economist.

The race continues with FOMO is a potential danger to AI Labs taking short cuts and threatening safety.

Dario Amodei the boss of Anthropic predicts AI will cure previously incurable deseases and puts safety at the core of its innovations. Businesses seem to trust Anthropic's Claude.ai model more than OpenAI but the latter has 10 times the recurring revenue of Anthropic. More data and more computing power, new data centres going live over the next two years will increase the speed of innovation even more and the parallel insatiable need for new funding.

China's DeepSeek released two models that matched US leading models but is not transparent about the inner working and safety of its models. This competition sparked US Deputy President J D Vance to say “ The AI future will NOT be won by hand-wringing about safety”.

But insurers will need to.

There are four powerful ways that AI could go wrong.

- MISUSE by powerful individuals and or groups

- MISALIGNMENT; AI vendor management and its creators may not want the same thing as investors or insurers.

- MISTAKES; AI might cause harm by cumluative mistakes or one spectacular mistake

- STRUCTURE RISKS; no one person or model breaches safety but harm still occurs:-

- Bio Hazards- several labs are trying to stop models from following every instruction the model reasons and creates:-

- Genetic Engineering

- Cyber Security

- The models themselves are the first line of defence

- But jailbreaking is more an art than a science

- AI Labs has introduced a second layer AI to model and manage the first layer

- There is unease about open source models eg Meta's Llama and DeepSeek R1

- Both companies have their own moderation but what's to prevent those who download these models from modifying and removing a moderation layer?

- What happens when the model itself reasons that the moderation conflicts with its own goals which it evolved and set and then overrides the moderation?

- Bio Hazards- several labs are trying to stop models from following every instruction the model reasons and creates:-

- Only Google Deepmind, OpenAI, Anthropic and Meta make public such moderation

- DeepSeek and and XAI have not made public any such moderation

This means insurers need trusted partners that closely monitor each model, new releases and and ensure that insurers enjoy safe and compliant outcomes. I describe a number of these in section 6 below.

2 Barriers to GenAI and AGI Adoption

For every forecaster predicting an apocalypse another insists there is nothing to worry about. Sceptics do worry that AI Labs are not doing enough to prepare for the possible doomsday outcome. Driven by the never ending need for more funding they could cut corners and commercial greed may overcome responsibility. It is not as though boom and bust has not occured before costing all industries pain and cost. Remember the eCommerce hype?

Blockchain might be maturing now but not to the revolutionary hype cycle promoted by early vendors.

The cloud service providers Microsoft, Google, Amazon have and are investing humungous $ in these AI labs and also hedging their bets so they don't know who the eventual winner(s) will be. VCs follow in close footstep. This could lead to another crash as losers are identified with a consequent flight of capital just as happened with early eCommerce vendors. Tomorrows AI technolgies might make obsolete today's so what would the replacements deliver?

"Tech firms are raising capital because they think that the gains from AI will be concentrated among a few players. Investors are lending to them because they know the same thing is true on Wall Street.

This symbiotic escalation is, in some ways, an advert for American innovation. The country has both the world’s best AI engineers and its most enthusiastic financial engineers. For some it is also a warning sign. Lenders may find themselves taking technology risk, as well as the default and interest-rate risks to which they are accustomed. The history of previous capital cycles should also make them nervous. Capex booms frequently lead to overbuilding, which leads to bankruptcies when returns fall. Equity investors can weather such a crash. The sorts of leveraged investors, such as banks and life insurers, who hold highly rated debt they believe to be safe, cannot"

The Economist

The barrier of an enterprises's middle management

Unless middle management know, understand and support the vision and strategies of the companies they work for they will tend to block POCs and trials leading to what McKinsey descibes as ‘Pilot Purgatory’ . It is not restricted to AI as it is common for only 5% to 10% of trials to result in successful and transformative outcomes. I have written much about this as has Rory Yates well known across the insurance industry. Constrained by a RFI/RFP process which typically asks vendors to auitomate existing processes rather than consider the future and help identify compelling outcomes that deliver competitive advantage and better customer service and satisfaction. If you don't know why you want a pilot just don't bother trying. You must know why, when, who it will involve, where ,and measure the outcomes against set goals. That must mean delivering a minimal viable product (MVP) at the very least and not just pretty slides, a meaningless demo and off the shelf platforms that prove unable to cope with the ambitious insurer's goals.

Death to the POC!

Maarten Ectors took that approach at Legal & General GI delivering an award winning quotation process with just six questions for customers to answer. This was followed by Home & Contents eFNOL augmenting a well trained and motivated claim handler team that delivered outstanding results.

Ectors moved to L&G Group as Chief Innovation Officer and now is an active founder of new AI and disruptive companies. Amogst other ventures one aims to manage the ‘lost jobs’ with a platform where specialists bid for work and key tasks and enteprises contract leveraging the new AI technologies. Sounds soulless but plausible.

My conclusion is that insurers can overcome these barriers but must have the right partners to collaborate, optimise priority use cases and deliver competitive advantage. See Section 6 below.

3 The impact of AGI and ‘Super Intelligence’ on jobs and insurers

Before 1700 the economy grew at 8% per century. In the following 300 years it grew by 350% a century. In the 2000's it settled at 2% compound p.a whilst today Europe languishes in the productivity doldrums whilst the USA, China and Asia expand faster.There is the possibility that AGI could deliver an explosion of growth. Say it was 20% or more p.a.? Some predict 30%

The costs of AI deployment would drop below that of labour resulting in many job losses. Super Stars would reap enormous benefits. Automation bottlenecks would boost wages for short periods until the bottlenecks eased and wages. Everone else would experience reduced wages and returns on investment.

New patterns of abundance and shortages would change buying and selling processes and prices. Fully automated AI powered factories would drive prices down and need very few operatives. Just a few highly skilled ones. Cautious factories would see their value collapse with consequent wild swings in stocks and shares as winners and loosers emerge. The repacious desire to invest and generate more AI power would create new infrastructure, data centres, factories with a parallel collapse in existing and unambitious companies.

Today ,Slough is the Data Centre Capital of Europe but is suffering a bottleneck; the ability to connect new ones to the UK's Electricity National Grid. The UK government says it will speed up new infrastructure investment but will it deliver? The same could be said for the USA.

Cloud Service Providers plan to open new data centres in The Gulf and elsewhere to avoid these bottlenecks. Will that not compromise safety?

Would humanity cope?

Politics would be even more volatile than today. Pursuading people and companies to invest would mean Central Banks raising interest rates and goverments refinancing debts of what they consider vital industries. But they are already in considerable debt and that is growing. Can they reconcile the current conflicting goals of supporting business, delivering real growth and cope with a voting public that wants all the benefits without any of the pain? Elon Musk believes President Trump's Big Beautiful Bill will result in unsustainable US debt. The UK's Labour Government makes constant U-turns as short term revenue raising decisions clobber business and have lead to job vacancies dropping and growth stalling.It's own MPs rebel against just slowing the increase in benefits spending and the reforming of planning permission bottlenecks is harder than thought. France suffers the same problems only worse.

Buffeted by the advances of AI will goverments survive or voters choose the next snake oil sales promises of rising parties in the polls? Voters have a habit of taking that route even though they know the promises will not be kept.

Will any government take the bull by the horns and really transform government and society? Take one area- Tax Reform. In the UK the books of tax and legal reduction of tax payments piles many stories high it is so complex exploiting every rule in the books. Armies of tax lawyers plan the legal reduction of tax paid by their clients. Productive for society- NO. Will a government simplify tax, maybe introduce Univeral Income to balance the concentration of wealth in rich holders of capital? That might stabilise society if it understands the goals and benefits and help delivery of new AI. Otherwise society may rebel.

2008 and the Financial Crisis may be forgotten by some but it was a vivid experience for me. How about you?

Therev are similar lessons applicable today. Debtors would suffer, nations that were unable to or unwilling to leverage AI (dodgy mortgages) would see flights of capital just as in 2008. The crisis was years in the making just like AI progress today. Few investors realised that the worst crisis in eight decades was about to engulf them. Home prices began to fall as unwise lending to uncreditworthy buyers (parallel with AI Labs?) gradually became exposed. In mid- 2007 Bear Stearns investment bank collapsed, BNP Paribas warned investors that they might not get their money back. In the UK private customers began to queue to withdraw cash from ATMs afraid that the Bank Northern Rock might run out of money as rumours circulated mouth to mouth, internet reader to another. Northern Rock had to go for emergency funding by the Bank of England to survive.

In September 2008 Lehman Brothers collapsed- the biggest US bankruptcy ever. Wall Street, The London Markets , Financial Markets in Asia wobbled and it took brave, decisive action by governments, Central Banks and Chancellors/Treasury Ministers to take control and prevent a total global economic collapse collapse. Just seventeen years ago.

You can readahow the seeds of that global collapse grew in the Further Reading appendix below. It would be wise to do so and remind us of the causes of the collapse and consider the relevance to AI today.

4 Optimal use cases for insurers

There is a big gap betweeen what insurers and some vendors may say and the actual truth. Here I will restrict myself to publicly available information plus my intuition and engagements.

Insurtech Insights describes how insurer Riverstone International partnered with AI and Data Management company Aiimi .

"Steve Salvin, CEO and Founder of Aiimi, said: “We’re thrilled to be building upon over a decade of experience within the insurance industry through our new partnership with RiverStone International. Renowned for their expertise in managing and acquiring complex portfolios, our partnership with RiverStone International presents an exciting opportunity for us to put the Aiimi Insight Engine to work.”

“There are unique challenges associated with managing such a vast data estate and complex legacy insurance liabilities, and valuable insights waiting to be unlocked at the same time. Our cutting-edge AI technology coupled with RiverStone International’s wealth of data hold the keys to a competitive industry edge for the firm,” he added."

Riverstone International has around $6.4 billion of liabilities under live management.

As a leader in the legacy sector it employs more than 500 professionals operating across multiple offices and affiliates spread across the UK, US, Malta, Ireland and Bermuda.

I know of one insurer buying a book of business only to find out too late that it included Russian business which the insurer explicity said it avoided. That''s the danger of unstructured data hidden in data silos, spreadsheets, csv files and PDFs.

Uncovering the risk cover details of policies might be unglamorous but it would help underwriters and claim handlers judge early on whether a claim was covered or not. Consider all those documents and slips that fuel the London Markets and the value of unearthing the detail. Digital data exchange is being deployed but many contracts will predate this.

One area considered ripe for improvement is claim handlers’ scripts. The same 10-question script for claims handlers managing a storm event may not be right for every situation. “Rigid claims scripts and manual processes no longer fit the complexity of modern claims – whether it’s a storm-damaged property, a motor collision with layered liability issues, or a business interruption claim,” says David Scott, partner at HF and managing director of HighFive.

Rory Yates describes the benefit of AI in the business model transformation of esure which EIS, EY, AWS, and Salesforce have implemented and deployed over two years or so.. In the Home & Contents market that included the integration and deployment of the RightIndem claims management platform with the EIS MACH architected core platform.

“Yates, global strategy lead at EIS, says the automation of call scripts is among the best use cases he has seen for Gen AI, helping call-handlers quickly understand a customer’s context and respond in a more informed, personalised way.”

I woulkd like to think that rather than scripts AI will augment claim handlers to have real, productive conversations with customers as the next step.

As a part of the business transformation model GenAI could augment human claims handlers just as Remy Gounel states-

“I used to be a claims handler, and I know how much correspondence and complex documents they face – the capacity of GenAI to summarise it means a huge gain of time. Rémy Gounel, subject matter expert, claims at Shift Technology” Insurance Post

I believe that the initial use cases will grow as both insurers and their technolgy partners experiment with, apply a test-learn-iterate-retest and prove the process to gain the capabilities and trust to build out more ambitious use cases.

Chris Pearce, COO esure, stated that it has deployed 6 GenAI use cases to date with more in the pipeline and they have deployed both from their claim module for motor and integrated RightIndem for home claims.

The AA has the claims module from its core platform ICE whilst in parallel deploying motor claim digital FNOL and claim processing from RightIndem.

The number of lines of business is one deciding factor, the various core systems, typically different for each LOB, are key factors in this decision process.

In conclusion there is no magic answer so I encourage you to select trusted technology partners to experiment, start small and build out use cases rapidly.

5 Which partners can you trust?

The list below is neither exhaustive and is based on my own engagement with the companies listed and having had to place my own job and reputation on the line managing a large $17million transformation project that delivered over target, under budget and only a little late.

Modern MACH architecture core and PAS platforms will be part of an integrated ecosystem in which data flows across the whole value chain. Insurers have mostly relied on the gorillas in the market but even modern legacy platforms will limit an insurer's ability to leverage AI fully.

The UK's FCA industry regulator has stated that the “regulatory foundations” for the first Open Finance scheme are to be in place by the end of 2027. Prioritising small business lending, “so these engines of growth can better access capital”. That perhaps gives insurance a chance to get ready, and lay some new foundations first.

The risk is that the industry is once again caught napping, and the potential left untapped. Seamless data sharing across the whole financial ecosystem like that laid out in the Centre for Finance, Innovation and Technology (CFIT) Blueprint report will require operational data models, and integration capability that doesn’t really exist yet in insurance.

This will take new insurance business models built on technologies that make this possible. MACH based, event data streaming and AI harnessed as needed. Change will need to happen across the industry, but I am confident this change will come.

Examples include (alphabetical order) : -

- EIS- describes its deployment of AI for esure. Chief Strategy Officer Rory Yates is well known in the industry for his insights and advice, including the pros and cons of deploying all AI tools, including GenAI. Describes the success with esure on its website.

- FintechOS- strength and focus initially on banking; now expanding into insurance and AI deployment. Scott Thompson is the insurance lead

- Genasys- clients include Simply Health and many MGAs. Group CEO is Andre Symes; the CRO is Gavin Peters

- ICE has many insurance customers listed on its website. ERS Motor Insurer, Ticker, Provident Insurance, The Hood Group (travel insurance). ICE is part of the Actuaris Group. CEO Andrew Passfield

- Instanda has`` many insurance clients, including Vitality for its core platform and transformation services. CEO Tim Hardcastle and Group CRO Derek Hill

AI and Data Management technology partners that can steer you through the AI, GenAI, AgenticAI, SpacialAI and AGI journey of experimentation with safety and complaince as a priority:-

For larger Tier One and Two Carriers,Global Insurers, Reinsurers and the large global Brokers and emerfging large MGA groupings as US MGAs scoop up British MGAs

- EY - proof is in the esure use case quoted on its website- Chris Payne heads up the insurance practice; you'll see him at many industry events

- Service Now acquired Moveworks to extend generative and agentic AI. Able to scale and operationalise across the whole enterprise like EY. Nigel Walsh heads up the insurance practice

- Capgemini publishes valuable survey insights and has partnered with AI-powered pricing and underwriting insurtech Hyperexistenial, which claims to validate every data source used to allow insurers to validate for adherence to compliance and regulatory standards before deploying. on July 7th Capgem announced the acquisition of BPO WNS Group which many Tier One insurers outsource parts of the value chain to. WNS has a strategic partnership with digital claims platform insurtech RightIndem to transform claims in a transformative ecosystem. Luca Russingan is the Capgem Senior Director, Insurance Intelligence.

- Accenture acquired Altus Consulting, which analyses an insurer's digital maturity and how to fill gaps for future innovation- Mark McDonald heads the Insurance practice in the UK

- BCG is well known, though I have no direct experience. It has shared the stage with with AgenticAI tools partner Kore.ai

- KPMG- Hew Evans is Head of Insurance in the UK and Matthew Smith is the Partner for Strategy & Transformation and Global Claims Lead

- Salesforce.com- acquired Informatica to deliver AI across insurers; good fit with customers of its CRM, Sales, SaaS, and marketing platforms

- Publicis Sapient- growing its insurance customer base. Was the implementation partner that I chose in the hotel project from a short list, as they proved more collaborative and put skin in the game. Dan Cole runs the Insurance Practice

- Hitachi Digital Services- Hitachi is part of a massive global implementer with strong experience in Building Management Systems (integrate with insurers for preventative maintenance) and strong AI and other capabilities. Stuart Reeder heads up the Insurance Practice

- Palantir made its name and dizzying valuation delivering AI to governments, particularly defence in the USA and the NHS in the UK. Licensing a tad expensive even for Tier One insurers, but they offer some compelling solutions and a test-learn-iterate-prove culture and workshops. Value, as with the other partners I list,must be in the eye of the beholder.

- CGI- well respected in government, CGI has ten of the top UK insurers as customers of its Ratebase Insurance rating and pricing platform , and its Underwriters Workbench. Darren Rudd is Head of Insurance and technology business consulting, and will listen to your requirement and be realistic about satisfying them.

- PCW's insurance practice includes Automation, AI, and digital ecosystems: product design, underwriting, pricing, and claims.

- Maarten Ectors - I first met Maarten when he was Chief Digital Officer at Legal & General General Insurance. He invited innovators to a 5 day workshop with the L&G Teams for 4 streams one of which was claims transformation. He rejected the RFP/POC process and instead wanted the innovators to present their solutions to The CEO and C-Suite Friday morning. One outcome was a team of well trained L&G claim handlers augmented by technology winning a Smart Claim award for L&G , satisfied customers and better GI ratios. Maarten transferred to L&G Group as Chief Innovation officer, won more innovation awards, and now runs AI start-ups. He can certainly advise and oversee large, medium and smaller insurers. His pace of innovation may be a challenge to the cautious! Currently founder of Greentic.ai an open source platform “To create armies of digital workers". Worth meeting

For Mid-Size Insurers Tier Three and smaller, Brokers and MGAs

- Aiimi Limited; Aiimi made its name enabling Water Utilities locate and reduce water leaks by accessing unstructured data using its AI-powered data management platform that will also make data AI-ready. It counts the FCA as a client and Riverstone International as an acquirer of legacy books of business. JLR and The Cabinet Office are named clients. It names PwC as a business partner. The CRO is Mark Drayton

- Kore.ai is a US-headquartered Agentic AI partner with a European presence and support in London. Johnson and Johnson and Morgan Stanley are two of many global clients. The Chief Strategy Officer is Cathal McCarthy

- AI Risk: a community of innovators that develops and deploys AI. It has built an agentic AI platform for a broker and is demonstrating a production version of this. On its website an operational deployment is described in a case study. I have a feeling it's a smallish broker ( 6 or so humans). The CEO is stated as being unable to recruit key people (humans) and has replaced all with digital agents. I have a feeling that can work better for a broker or MGA, whilst large insurers data issues will be a challenge. AI Risk certainly advises large insurers so worth talking with Simon Torrance who is the founder and CEO

- Outlier Technology Limited. A blog on LinkedIn caught my eye. 'The best thing a business can do is forget AI exists' - tech CEO I called CEO David Tyler and found he had delivered a major data and AI project for a large utility that had spent £4m on a POC to meet regulatory compliance demands by a fixed date- a real problem. The POC failed despite it being a technical success. That pilot purgatory in action! The human end-users found it useless and rejected the deployment. Outlier was retained to make it work and ensure the users embraced it, which they did successfully. Outlier can collaborate to deliver even large projects cost-effectively as long as you share domain knowledge and collaborate with all your stakeholders. Outlier can build out a test, learn, and iterate MVP process until you are happy with the result. Worth a chat with David and his team.

- There will be many other potential partners- I have listed those I have personal experience with and those insurers have used.

Most insurer's cash flow is managed via the claims operation until recently mostly considered a cost centre rather than a business. A few CEOs of UK insurers have been shown the exit door as claims inflation adversely impacted ratios and company losses grew beyond the patience of shareholders. Claim technology partners in aphabetical order:-

- 360 Globalnet

- Claims technology with Synergy Cloud

- Home and Property focus

- Cotality, the CoreLogic rebranding

- Home, contents, property, and supply chain ecosystem

- Five Sigma- transforming insurance with its AI claims adjuster is similar to RightIndem, and years of research made me list the two as the best for insurance to shortlist

- RightIndem launched its AI-powered claims assistant that guides claimants to more accurate and detailed eFNOL solututions faster. It names WNS Group as a strategic partner delivering Rightindem embeded as part of its outsourced services for insueres like \howden Group and Zurich. CEO is Julie Rodilosso and CSO Rich Massingham

My research over the last few years suggests that RightIndem and Five Sigma offer the ultimate option for multiple lines of business, digital FNOL, full management from FNOL to settlement, and the ability to deploy GenAI and other AI tools. Combined with the MACH architecture core platforms, the combination offers cost-effective solutions.

For those focussed on property, home & contents- Cotality is an established technology partner from eFNOL to supply chain orchestration and Synergy Cloud a newer MACH architected alternative.

Further Reading

Phew! I hope you made it this far and value the insights and suggestions.

The 2008 Financial Crisis Explained

To read in parallel- Will GenAI and Agentic AI transform insurance claims management for insurer's competitive advantage?

Johnson & Johnson Pivots Its AI Strategy-its CIO Jim Swanson Chief Information Officer Jim Swanson said the move ensures that the company allocates resources only to the highest-value generative AI use cases

McKinsey July 2025 playbook ‘Seizing the agentic AI advantage’. You'll have to scroll down to find it as well worth the effort with other interesting surveys and articles.

Capgemini World Property and Casualty Insurance Report 2025 They'll send the report, and no paywall either.

Short-term tactics v long-term transformation strategy from Insurtech World

C-suite expectations may be too hasty (and underinformed) to deliver meaningful AI value responsibly. Salesforce CIO Juan Perez is among those IT leaders who believe such impatience from the C-suite could doom many projects.

The dark horse of AI labs from The Economist

AI labs’ all-or-nothing race leaves no time to fuss about safety The Economist

The economics of superintelligence The Economist. I like reading the views of analysts outside insurance to help avoid us gazing at our navels and becoming too complacent when we agree with each other.

IT IS COMMON enough for new technology to spark a moral panic: think of the Victorians who thought the telegraph would lead to social isolation or Socrates, who worried that writing would erode brain power. But it is unusual for the innovators themselves to be the ones panicking. And it is more peculiar still for those same anguished inventors to be pressing ahead despite their misgivings. Yet that, more or less, is what is happening with the tech world’s pursuit of artificial general intelligence (AGI),

unknownx500

unknownx500