Growing discontent over premium prices and delayed payouts

It's one thing to have to pay significant increases in auto premiums averaging 40% (source: confused.com car insurance price index) as insurers catch up with claims inflation caused by increased labour rates, energy costs, and higher replacement parts & components costs. Putting salt in the wound is the problem of a 90% increase in complaints about delays in claims settlement. Claim values and declined claims are other common causes of dissatisfaction according to the Financial Ombudsman Service.

Consumers suffering from UK inflation rates of 6.7% over the last 12 months( source: The Economist) have little sympathy for the woes of auto carriers that have suffered worsening combined ratios in 2023. Especially after years of carriers penalising loyal customers by tempting new customers with low prices whilst 'over-charging' those that didn't shop around on price-comparison websites.

Consumers will also have noted in the press that supply chain disruption caused by Covid, mass lock-downs in China, and a consequent shortage of parts and materials are a thing of the past.

Lack of communication has always been a cause of complaint in times of low inflation, well-staffed repair networks and plentiful replacement parts. When delays stretch out it highlights the gaps in communication, coordination and effective supply chain management.

"The car insurance sector has been under regulatory scrutiny in recent years. The Financial Conduct Authority said last December that it had seen evidence that motor insurance customers whose cars had been written off in a crash had received payouts lower than fair market value. In June, the regulator ordered Direct Line to review claims paid out between 2017 and 2022. This month, the motor insurer said it would spend £30mn refunding customers it overcharged for home and motor cover."

FT 14th Sep 2023

It's not only auto claims either.

Building insurance complaints rose to 1,776 cases at the start of the financial year, compared with 1,642 in the same period last year. Travel insurance cases, meanwhile, more than doubled since last year to 1,101, the highest figure for travel insurance complaints in more than a decade.

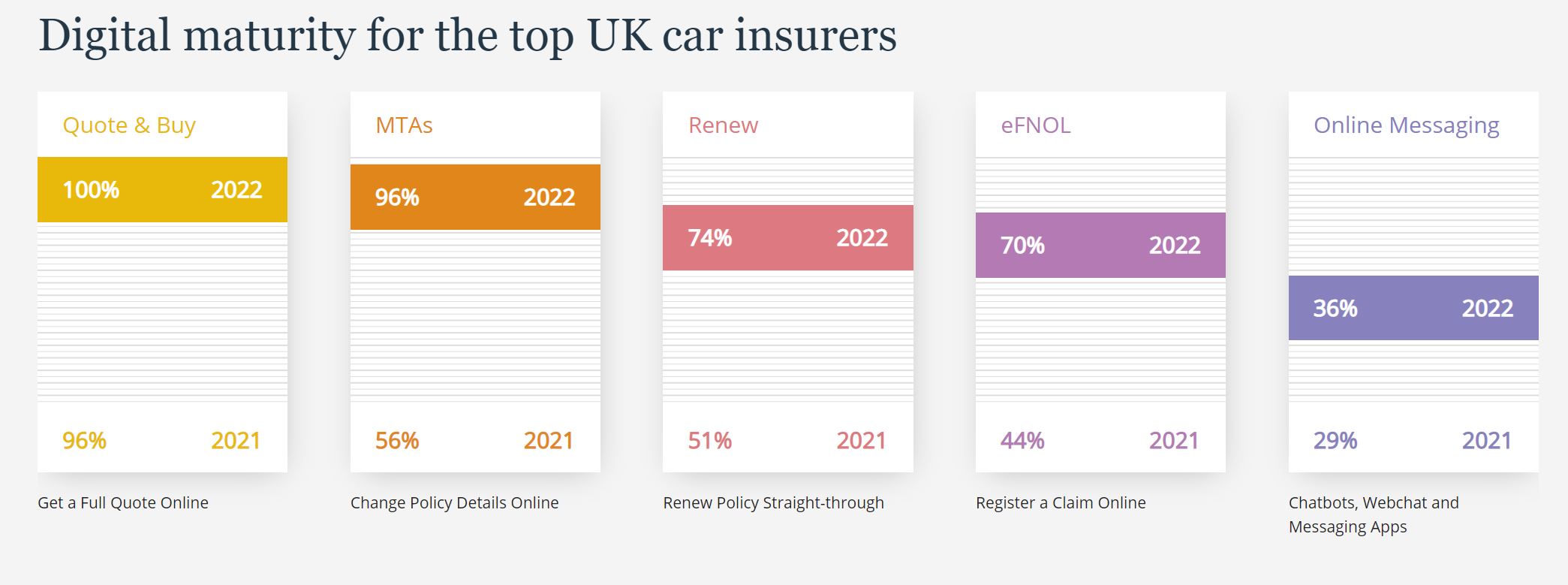

Over the last five years, digital transformation has been high on the agenda of insurers. AS is often the case, the claims business unit has tended to lag behind sales and distribution as you can see in the Altus Digital Bar

eFNOL at 70% lags behind Quote and Buy though it has increased significantly since 2021. The 2023 data is expected soon which is something to look out for.On the other hand, it is one thing to be able to register claims online from the phone, tablet, or laptop. Quite another to enjoy updates on progress and what to expect. Online messaging has increased only from 29% to 36% according to the Altus survey.

One reason for that is the complication of managing supply chains with so many different partners. How many claims operations allow customees to choose and book cars in with a conveniently local repair shop? How many have effective co-ordination between the repairer, the insurer, and the consumer? How many automatically update customers with progress to keep expectation realistic?

Then she could have been automatically connected to 'National Windscreens', 'AutoGlass' etc, and even be able to continue a digital journey there as they would have an orchestrated digital claims journey and explicit vehicle details from the carrier. Just click on the driver's side glass image and AutoGlass can order the glass and let me book an appointment at home that suits my wife's diary.

Then she could have been automatically connected to 'National Windscreens', 'AutoGlass' etc, and even be able to continue a digital journey there as they would have an orchestrated digital claims journey and explicit vehicle details from the carrier. Just click on the driver's side glass image and AutoGlass can order the glass and let me book an appointment at home that suits my wife's diary.It didn't work like that of course. She had to ring a claims handler who was very pleasant and confirmed her identity, the car details, ask for a brief description of the event, and then automatically put her through to the windscreen replacement company.

Another pleasant lady who asked the same questions again, said they would order the glass from the manufacturer (OEM parts only) and booked an appointment 10 days out to ensure the glass was delivered to the local depot in time for fitting. And sent a technician around that day to vacuum out the car and put a temporary plastic cover to protect the car from rain. All-in-all a good service.

Empathy6 and the personal touch.

On day 9, a phone call; we have not received the glass yet so "when we receive it, we'll ring you to arrange the fitting".

"When will that be?"

"We are waiting on the dealer".

"Can't you ask them when"

"They can't say"

Satisfaction sliding, but she was so nice, we'll give it a few more days. Another 5 days and I rang the glass replacement company.

" Well, they sent the glass, but to the wrong depot"

"When will you get it at High Wycombe then?"

"Hopefully tomorrow".

"So can we book the appointment?"

"I'll ring tomorrow".

Well she did, and the glass was fitted two days later by a very pleasant technician with a nice smile.

This was a very simple claim and the customer, my wife, was still left with a somewhat negative perception of lack of efficiency, lack of communication; all this whilst her renewal premium had increased.

Whether digital or call an agent FNOL, the claim can go wrong without the coordination between the replacement glass supplier and the OEM dealer network. In fact, the customer might feel even worse as a slick eFNOL accelerates the claim towards operational buffers. All the details must work throughout the entire value-chain.

How much more serious is it for complex damage repairs with multiple suppliers involved to repair vehicles, credit company for a replacement vehicle and, with third-party involvement, the need for liability investigations and subrogation? The combination of domain experience, customer knowledge, and technology partners must plan and cater to every detail and not just a digital front-end.

Transformation is about far more than digitising current processes. It's about looking at the whole claims journey from reporting the incident itself to the final settlement whether it is a restored vehicle, a cash settlement for a total write-off, or during the intervening period in which replacement vehicles, courtesy cars, roadside services and so on are organised and delivered..

The same story for escape-of-water (EOW) claims where unnecessary time delays and costs can easily escalate when contractors and sub-contractors are not orchestrated effectively with technology enabling claims teams to manage the whole process with visibility of damage, proposed remedial action and equipment involved.

Just having eFNOL is one thing. How effective is it? Does it improve on the previous 'analogue' journey? How does the carrier build out a complete, effectively orchestrated ecosystem of all the software and platforms to deal with not just FNOL but all the processes, workflows, and participants in putting the customer back on the road?

How do they organise the human participants and companies involved? With a tremendous combination of vision, strategy, resourcing, project management, buy-in across the whole organisation and attention to detail. The whole transformation project will success or fail on the effective execution of detail.

This video from the WNS Group visualises the potential outcome and you can see that it partners with RightIndem, Bail, Entegral, Verisk, and others to deliver this transformation goal.

It has the people and domain experience to support carriers but carriers have to put the same commitment in and know that every journey starts with a first step. And there are many steps to reach the heights of the goal.

Geoffrey Moore, of 'Crossing the Chasm' fame, writes of the commitment required picturing a hard but vital 'stairway to heaven'.

" Because of the new digital economy, because of changing customer expectations, because of aggressive competitors coming at you with advanced technologies in tow, you have seen you are going to adapt, and fast. Specifically, you must change the way you operate, decommissioning the old methods to implement the new ones.

To begin that journey, you need to build clear representations of your current state and your desired future state. Capturing your current state involves an act of description.

Capturing your desired future state requires an act of design. If you do not have a clear design for your future state, you have no north star by which to navigate your digital transformation, and it cannot possibly succeed.

So, let us assume we have a clear design for our desired future state. It won’t take you long to realize there is little chance that a single intervention can get you from here to there. So, the next major deliverable must be a roadmap organized around a maturity model. What Moore describes as a stairway to heaven. Each step up the stairway should be designed to deliver value upon completion, thereby allowing the organization to pace its change management, funding things as it goes, building its confidence, and reassuring its various stakeholders.

With such a roadmap in place, now you have a current-state/future-state accountability mechanism that can govern each stage of the transformation—the software and systems, the systems integrators, the process owners insider your enterprise, and the people responsible for executing the processes. As we have noted elsewhere, digital transformation is not a restaurant. You cannot simply pay for it and have it delivered to your table. It is a gymnasium. You still must pay for it, but to get any value out, you have to actually do the transformational work yourself. Transformational software, in other words, is like a Peloton—it’s cool, but only if you engage."

Who is treading that stairway? Who can you take inspiratioin from?

One might well be esure powered by the acquisition by Bain Capital.

“We’re on a mission to transform our business into a world-class digital insurer, and to disrupt the insurance industry” – David McMillan, CEO at esure.

esure is undergoing a transformation programme across the whole business that will result in a world-class digital ecosystem; leveraging cutting-edge processes and technology, insights, and data, alongside fantastic customer service, to deliver more personalised experiences that meet the evolving needs and expectations of their customers.

The programme includes the delivery of a new insurance technology platform that fits into its evolving architecture – cloud-enabled, open, and compatible with microservices and API stacks. Forming the backbone of esure’s technology platform are:

- Cloud-based Amazon Web Services (AWS);

- Omni-channel contact centre Amazon Connect;

- The US Digital Insurance Coretech platform from EIS; and

- The RightIndem Digital Claims Platform

At Insurtech Insights Europe, esure's Chief Strategy and Transformation Officer Roy Jubraj explained the massive amount of planning and hard work required to become the “Insurer of the Future”.

“Our technology partners have been carefully chosen and we have E&Y leading the programme to help ensure that these ambitious goals are achieved.”

Of course, it is far more than just claims but when Bill Pieroni, CEO at Accord, was asked on a recent Insurtch Insights webinar " In your view is there one area of insurance where digitisation can add most value for customers" his reply was "Well I like going where the money is .... 75% of premium dollars show up in LAE and loss.... claims is where the money is. "

You can read about the esure case study here.

At a smaller carrier the AA is putting its members first whether they insure with the AA or not.

Tim Rankin, managing director of AA Accident Assist, said: “This launch supports our ambition that Accident Assist becomes the natural first contact for all our members and insurance customers after an accident. We know that customers increasingly expect a digital experience, and we’re delighted to now offer a simple and easy to use online journey. This investment is one component of a wider customer-centric strategy to build for the future at the AA.”

The AA is accelerating its modernisation and tech transformation by launching a new digital claims platform for members and insurance customers through Accident Assist.

The new service is available on the AA’s app or website and users will be able to self-serve and report a motor insurance claim, avoiding the need to contact the call centre.

The AA has teamed up with RightIndem and over the next 12 months, the platform will evolve to provide a complete end-to-end online customer journey including the ability to track the progress of a claim.

Zurich has won awards with its home claims transformation and partnership with CoreLogic and Sprout.ai and Ecclesiastical with CoreLogic. It is always good to look at new initiatives whilst recognizing that technology is only one part of the issue. That is why Daren Rudd Head of Insurance Consulting and Technology at CGI dislikes the term 'digital transformation' as does Geoffrey Moore who explains the digital transformation paradox.

Digital Transformation Paradox.

"The paradox is simple to state, involving as it does two seemingly contradictory statements:

- You cannot digitally transform your enterprise without software.

- Software cannot digitally transform your enterprise.

Everybody gets the first one, but a whole lot of people have missed the second. Why? Why would we ever think that simply by installing new software our enterprise would be transformed?

The answer is interesting. For the first two decades of widescale deployment of enterprise software, we did get what appeared to be transformative returns simply by installing new software. But here’s the thing. The returns came from automation, not transformation.

That is, if all you are doing is automating an existing process, then software alone can do the trick. Robotic Process Automation (RPA) is a good current example. Buy some UIPath or BluePrism, target some bit of workflow, engage an expert in that process to help, and zip, bang, boom—the process can run by itself! Now, if it is a complicated process, you will need a more robust tool for this, so you might buy some WorkFusion software to take that on. The point is, in neither case are you transforming anything. You are just automating it."

Geoffrey Moore

Transformation requires the vision and commitment that David MacMillan explains above. It also needs technology partners that have the interest and commitment to help insurers achieve ambitious and transformative goals. Partners that are interested in the insurers's goals rather than primarily their own.

I suffered the opposite when in charge of a major transformation project at Hilton Hotels. Vendor after vendor primarily interested in TELLING me how their software and platforms transformed business without fully understanding my goals and challenges. Major Global consultants and systems integrators that put an A Team into the sales pitch but a B team into the execution. I remember two that had been selected being fired for that.

We went back to step one and asked why we wanted to transform. The reason was disruptive travel agents 'stealing' our margins and primary customer contact by offering a better online reservations CX and prices than we did.

The Senior Executive VP Tim Davis had the prescience to go back and find out what customers actually wanted rather than what we thought they wanted. Now and in the future. 12 months research using Insead Business School for in-depth interviews, data, analyses, and inter-company comparisons. That's before planning the transformation and finding the technology partners that would support us.

We had to develop, test, and refine the vision and goals but with the critique and help of outside experts to test our plans and ensure we didn't just automate existing processes and services.

Insurers can't just ask technology providers to provide that vision. In esure's case they utilise EY to help build the vision and EIS, AWS, RightIndem to provide the adaptive technology that would support both the disruptive transformation and the ongoing continuous improvement and innovation process. But the C-Suite and management must take responsibility for the what.

I referred to inter-company comparisons in the Hilton Transformation Strategy. Not just to leapfrog incumbent competitors but also to anticipate disruptive new entrants like Airbnb.

I recently met Tom Helm, Head of Claims Consulting at WTW, which provides such inter-company comparisons for UK insurers. Not just for the products compared to other insurers but also, the services delivered by supply chain partners.

If a carrier is going to allow customers to book their car into a repair shop that is convenient for them does that repairer deliver good repair quality, reasonable lead times, and competitive cost? If not the customer will not get a fair deal and neither will the insurer. We are back to the challenge we started this article with.

Without exhaustive and current data to deliver such insights how is an insurer to achieve effective and long-lasting transformation?

Technology providers are often guilty of not supporting this intensive process of transformation being too interested in licensing revenues, and quarterly reports, and reliant on expensive, inflexible, and complex software.

And what of embedded insurance?

Embedded insurance at the point of sale is seen as a major growwth market e.g. the new breed of banks like Revolut, Starling, Monzo etc. They have invested a great deal in products, customer experience and satisfaction. Should they entrust their brand to an insurer whose claims experience is worse than the banks' high expectations. For at some stage the customer will make a claim for travel insurance, gadget etc.

Shouldn't the bank have visibility of the claims from FNOL and the status? Measure performance against SLA's?

The same goes for online retailers; I cannot imagine Amazon giving free reign to the insurers on its home insurance panel. Nor Mobility Service Providers.

Transformation is not just for claims of course but, whilst once looked at as just a cost-centre, today more enlightened insurers regard claims as a strategic asset. Not a poor cousin of underwriting.

Transformation is for the whole business and all parts deserve a homegenous company-wide vision and strategy.

Many platforms and much software are the opposite of adaptive and more focussed on automation rather than innovation. The antidote to that inward-looking approach is provided in papers by thought leaders like Rory Yates and Andre Symes.

Read 'Adaptability' by Rory Yates which includes a critical review ' The Sad Truth about Insurance Technology'.

Download 'It's time to be Pro-Adaptive' by Gavin Peters CMO at Genasys Technologies.

Read 'The Secret to Attracting Talent?' by Andre Symes to avoid being inward-looking.

Still suffering from data silos, a lack of the right data to deliver the right insights then download these guides in plain English rather than techno-babble.

Challenged to experiment safely with Generative AI, ChatGPT? Download this plain English guide.

You can find out tips and help in achieving true transformation from me; drop me a message on LinkedIn.

Above all, take transformation to heart rather than just automation

“Having the right insurance is fundamental and should offer people the peace of mind that, when things go wrong, they’re protected,” said Abby Thomas, chief executive and chief ombudsman at the Financial Ombudsman Service. “Where these complaints are driven by insurers delaying paying out on claims that’s unacceptable.”

https://www.ft.com/content/05754758-1110-4aa0-a00b-4785c5309008

unknownx500

unknownx500